Tesla (NASDAQ: TSLA) stock split 5:1. The price has changed accordingly with its increased volume of shares, making its stock more available to retail investors, who have become more prevalent and populous during 2020.

TSLA stock has officially changed in price on Monday, August 31, 2020 and is now available at $442.68 per share. The price change came after a 5:1 split by the stock, which was approved on August 11th by Tesla’s board of directors.

As the COVID-19 pandemic spread around the globe and changed life as it was once known, entertainment literally stopped. Sports and shows stopped to prevent the virus from spreading, companies closed and stocks crashed. As the world was changing, however, it was a generational chance for young, affluent investors to get their first taste of Wall Street as business valuations fell due to closures and lower demand.

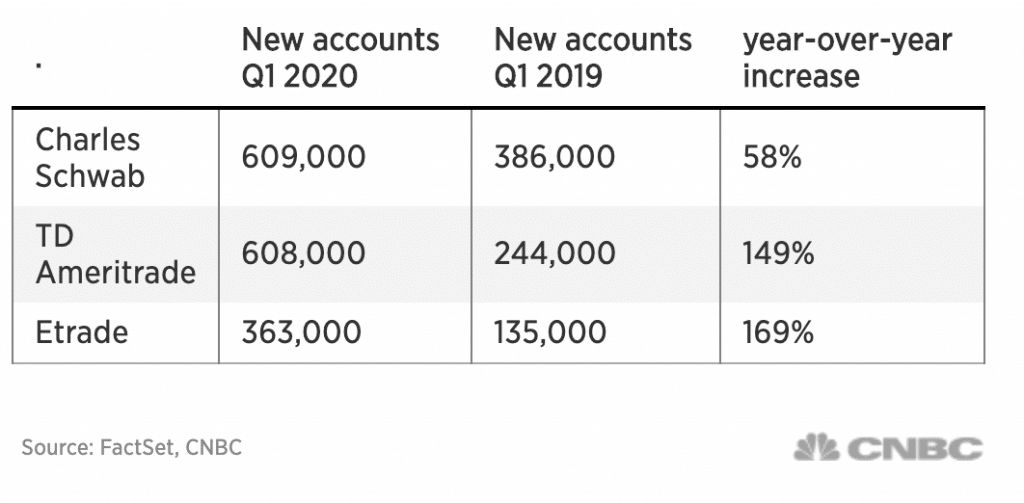

Although some corporations were wilting in the aftermath of the pandemic, other organizations expanded. One such organization was online brokerage companies such as Robinhood, Charles Schwab, and TD Ameritrade, all of which announced rises in accounts during the first quarter of 2020.

Some of these companies have seen a 170 percent increase in new accounts, showing that investing with your smartphone is easy and available. In Q1 2020, Schwab, TD Ameritrade, and E-Trade all announced significant increases in account ownership compared to the same period previous year. Schwab’s accounts rose by 59 percent year-over-year, while TD Ameritrade and E-Trade saw a rise of 149 percent and 169 percent, respectively.

Why are those sites building more accounts? This is down to supply, TD Ameritrade’s JJ Kinahan said.

“Perhaps because they’re home or perhaps because of furloughs, they also have time to dedicate to their investments that they didn’t necessarily have before,” Kinahan said to CNBC.

However, no-fee trading and mobile connectivity have also pushed a younger generation to become active in the marketplace.

“I think a lot of the innovation around trading commissions has really driven the accessibility of the markets for everyone and clearly that cohort, the younger ones, are seeing it for the first time in the headlines every day,” Tim Welsh of Nexus Strategy said to CNBC.

In terms of retail investor trading volume, it doubled in 2020 compared to last year as now, according to Citadel Securities, 20 percent of daily stock market activity comes from individuals.

It is unclear if Tesla knew retail investors were engaged in trading due to the pandemic. The company found, however, that its price-per-share increase in 2020 was not attractive to younger individuals or to institutional investors as a whole, so it performed the split.

CEO Elon Musk suggested a split on June 30th, when @TeslaGong reported that a split stock would give the company’s own shares more fans. Although Musk said it was “worth discussing at annual shareholder’s meeting,” the company completed a split more than three weeks before that event will take place on September 22.

Allowing fans, employees, and individual investors contributes to Tesla’s mission as a company. Past selling vehicles or placing solar panels on homes, the aim is to accelerate the world’s transition to sustainable energy. By increasing the number of individuals owning the stock of the company, Tesla is effectively raising the number of supporters it has in making the target a reality. With the widespread availability of TSLA shares, more people will contribute to the fight against climate change.

Reported by Teslarati.

Want to buy a Tesla Model 3, Model Y, Model S, or Model X? Feel free to use my referral code to get some free Supercharging miles with your purchase: http://ts.la/guanyu3423

You can also get a $100 discount on Tesla Solar with that code. Let’s help accelerate the advent of a sustainable future.