A shoo-in for success was the Nissan Leaf. A Chevrolet Bolt that can’t be missed. The Audi e-tron, an EV to show Tesla what the big boys could do. Those electric models were praised early on as game changers, but they didn’t change the game.

In the United States, hybrid cars have had a tough go of it. In 2014, the Leaf, one of the most popular non-Tesla EVs on sale today, had its best year, moving an average of 30,200 vehicles. (Nissan sold more than 400,000 Rogues here in both 2017 and 2018 for reference.) Even with Tesla doing a booming business, last year selling an estimated 223,200 cars, total EV sales in the U.S. actually declined from the pace of 2018. And apart from Tesla, after a decade of attempts, no other automaker has produced a true EV hit.

However, showroom failures have not dimmed excitement. Car manufacturers seem emboldened, promising an unparalleled number of entrants in the next decade in this sector. AutoPacific, a market research company, has an impressive 90 to 100 new electric nameplates coming to showrooms in the U.S. by 2030.

And the dollar sums laid down by automakers to make it happen are serious. In order to produce 20 new EVs by 2023, including a re-imagined electric GMC Hummer, GM announced it would invest $20 billion. As part of a $11 billion pledge to EV manufacturing that was announced in 2018, Ford is hanging its famous Mustang badge on the electric Mach-E. And the Volkswagen Group committed a tremendous $91 billion last year to the cause of EVs.

So, in the face of alarming sales, what’s fueling this surge of investment in an electric future? To begin with, carmakers have to comply with ever more stringent emissions regulations. In the U.K. the sales of new vehicles with internal-combustion engines, including hybrids, has gone so far as to set 2035 as the year it would be prohibited.

Then there’s Wall Street. Tesla alone has a market cap greater than the combined Detroit Three, which has intensified pressure on the old guard to remain on trend, besotted with EV startups and their soaring valuations.

The U.S. represents only a portion of the world of EV sales. China’s auto market was around 50% larger than ours in 2019, and customers in that country purchased three and a half times as many EVs as people here.

And even though the U.S. isn’t all that hot on EVs right now, it’s important to note that for global markets, many of these vehicles and innovations are being developed. Internal-combustion sales dropped 8.4 percent last year in China, the largest market in the automotive industry, while plug-in vehicle sales fell by 4.0, which translates into a marginal rise in EV market share.

Mary Barra, GM CEO, promises that the company’s expected “all-electric future” will see it shift 1 million EVs a year by mid-decade in the U.S. and China. That’s a lofty target considering it’s just 112,000 now, but in August, the GM-affiliated Wuling Hongguang Mini EV topped 15,000 sales, becoming the most successful EV in China. So things are looking up.

Back in the U.S., however, this EV disruption is difficult to see as a smart gamble. AutoPacific forecasts that this country’s EV market share will triple to 4.9 percent and 800,000 sales by 2025. Until you remember that Ford sells about 900,000 F-series trucks in a good year, that may sound like a lot. One reason for this low expected growth was cited by George Peterson, AutoPacific’s president: In the company’s daily new-vehicle satisfaction surveys of 70,000 car owners, no more than 5 percent of respondents said they would currently consider purchasing an EV.

There are several other indicators of trouble, not the least potential of a pandemic to devastate car sales, postpone releases, threaten vulnerable startups, and hold gas at low levels. Shellshocked consumers may see even less incentive to take a flier on a costly EV.

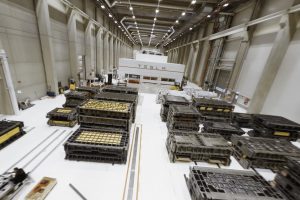

Advances such as the forthcoming Ultium battery cells from GM spark chipper reports on imminent market parity between EVs and internal combustion models, but a 2020 Bolt’s $37,495 base price shows that we are not yet there. That’s around fifteen grand more than a similar gas-fired economy vehicle.

Then there is the baggage problem. Brands like Buick and Cadillac, the premium-automotive world’s Magnavox and Westinghouse, can hardly market traditional cars to Americans. Are Lyriq SUVs and electric Escalades supposed to be hustling with Cadillac now? That’s a big request from the brand that brought the ELR to you. The situation is serious enough that analysts from Wall Street have proposed that GM change its company name to Ultium or spin off its EV company. GM has done neither, but it signed on to a $2 billion contract with aspiring carmaker Nikola in September. GM will use its Ultium batteries and hydrogen fuel-cell technology to engineer and develop Nikola’s Badger pickup in 2022. As long as there is no Chevrolet or Cadillac badge on the exterior, it is easy to imagine potential Badger customers not understanding or thinking about the GM-sourced components underneath the surface.

Similarly, by investing $500 million in dynamic start-up Rivian, winning a stake and access to its skateboard truck site, Ford is hoping to support its stodgy profile. It’s a smart move, particularly given the affinity for pickups in our country. That said, Ford isn’t the only one that’s worried about it. A coming army of electric pickups, including Ford, Chevy, GMC, Rivian, Tesla, Bollinger, Nikola, and Lordstown Motors mammoth-battery trucks, will be a real test of our EV appetite, considering the irony of our largest, most burly vehicles being suddenly cast as eco-warriors. R.J. Scaringe, the MIT-educated founder of Rivian, notes that without scaring off consumers, this segment will better absorb electric technology premiums, as truck buyers are already accustomed to paying $60,000 or more for internal combustion rigs. And don’t forget the size of the market. If only one in nine F-150 buyers can persuade Ford to opt for an electrified version, that’s 100,000 customers a year.

The majority of EVs have low sales in the U.S. but it proved that EVs are not necessarily undesirable when Tesla finally ramped up Model 3 production in 2018. One of the bestselling passenger cars of 2019 was its mass-market sedan.

However, if Americans oppose electric pickups, what then? Many observers say that because there’s no turning back, OEMs will actually retrench. GM and LG Chem are not building a battery plant in Ohio for $2.3 billion only to mothball it in a couple of years. For existing car manufacturers, the upside is that they have space to fail, whereas a newcomer like Rivian can only have one chance to get it right. Global giants still have investors to please, but with any new product, they are free to create concept cars, niche cars, halo cars, and even outright bombs without going hat in hand to investors. Without breaking the bank, their modular, scalable architectures and battery modules will allow brands to dump losers and pivot to new models. “Once you’ve got the platform, it’s not that expensive to put new top hats on it,” AutoPacific’s Peterson says.

Furthermore, gas won’t go away anytime soon. IHS Markit predicts that some form of internal combustion engine will still be featured in 87 percent of new cars in 2030. Stephanie Brinley, a senior auto analyst at IHS Markit, said a long game is being played by automakers. Consistency in the form of competitive models and coherent strategy can be as important as initial sales. “It’s a struggle in the beginning to get consumers to think about cars differently,” she says. “It’s not so important to sell 100,000 units out of the gate but to build the business.”

With time and innovation, the manufacturing process can get easier. Analysts reported in 2017 that GM lost approximately $7000 on every new Bolt sold that year. But GM says Ultium battery-cell prices will drop below $100 per kilowatt-hour by partnering with LG Chem and enable the company in the future to earn a profit on electric vehicles.

With automakers pouring investments into an electric foundation, it is helpful to think of this as the money-pit process. The work seems relentless and fraught with calamity. But they’ll operate a great company with enough time, resources, and confidence, both with stockholder curb appeal and the power to withstand potential economic storms.

Want to buy a Tesla Model 3, Model Y, Model S, or Model X? Feel free to use my referral code to get some free Supercharging miles with your purchase: http://ts.la/guanyu3423

You can also get a $100 discount on Tesla Solar with that code. Let’s help accelerate the advent of a sustainable future.