Tesla’s second-quarter earnings release and call confirm it is on track to continue to expand production like never seen before in the automotive market. I want to highlight a few key trends and what they tell us about what Tesla may do in 2022 and beyond. My thesis, for some time, has been that even though the Model 3 and Y are very desirable cars (I own both), Tesla will need to slash pricing and pull other levers to sell the massive volume of cars it plans to make next year. In this article published about 3 months ago, I discussed 8 demand levers. In this article, I’ll list a new demand lever and then update the ones mentioned before.

New Demand Lever

Tesla’s impressive increase in margins over the last quarter and over the last year was made possible by 3 main factors and one minor factor, according to Tesla CFO Zach Kirkhorn.

- Cost Optimization (Major)

- Cost Reduction Plans (Major)

- Increased Volumes (Major)

- Pricing (Minor)

While some think Tesla will work hard to keep high margins, we must always remember the mission is to “accelerate the world’s transition to sustainable energy,” not to become the world’s most valuable company. These high margins mean that Tesla has the freedom to lower prices in certain regions to take or preserve market share, without endangering the health of the company. Of course, a better situation for the company is if the following levers can allow Tesla to continue to sell every car it makes and Tesla won’t have to reduce prices more than its costs decline and trim margins.

This recent tweet by James Stephenson (who is a must follow if you are into the details of Tesla’s financials) shows how much room Tesla has for price cuts, if needed, according to his estimates:

Update On Previously Mentioned Levers

- Bring back the Standard Range Model Y. This is still needed in the US and Europe, but Tesla has already released the Standard Range Model Y in China. The combination of aggressive pricing, great build quality, and excellent design has made it a winner, with rumors being that it’s sold out for 3 months already.

- Use large castings to massively reduce costs and simplify build complexity (in addition to many other innovations, including battery innovations). Tesla confirmed that the Model Y in both Texas and Berlin will have both the front and the rear castings as a single piece (as opposed to the Fremont & Shanghai Model Ys that only have a rear casting). Tesla also shared that the Model Y will use 4680 cells in a structural battery pack, but that they are also preparing a way it can use the older cells in a non-structural battery pack as a backup. Tesla is learning to have several alternatives available, just in case plan A materials suddenly become unavailable or their supply becomes unexpectedly constrained.

- Use lithium iron phosphate (LFP) batteries to cut another $2,000 from the low-end Model Y’s cost. Elon gave further support using this demand lever. He mentioned that two-thirds of Tesla’s vehicles and virtually all of its stationary storage could use iron-based batteries because of the increased capability of newer LFP batteries. It seems the shortages of so many parts are pushing Tesla to more aggressively move to materials that are widely available today.

- Target extra deliveries to the countries and states that offer the best EV incentives. We can see Tesla adjust pricing and deliveries time and time again to maximize the opportunity governments around the world present to Tesla with their ever-changing incentives. In the US, it is unknown if Biden will be able to pass a bill that will make Tesla once again eligible for federal tax credits, but if the US does so, you can be sure Tesla will prioritize production and deliveries to the US to take advantage of the incentives.

- Tesla will continue to expand to new markets like India and Brazil, two of the largest countries in the world that Tesla has no presence in. No news came out during the call on these two markets that will be important in the longer term, since Tesla sees plenty of opportunity in the large North American, Chinese, and European markets right now.

- Tesla is ramping up its insurance product in many areas, and this could help reduce the cost of ownership. No updates were given on this product, which is a key to reducing the total cost of ownership of Tesla vehicles. As Full Self Driving gets safer, it will offer a significant competitive advantage, but at this time, you can still save money by judging the quality of the human driver (even if not yet dramatically reducing accidents).

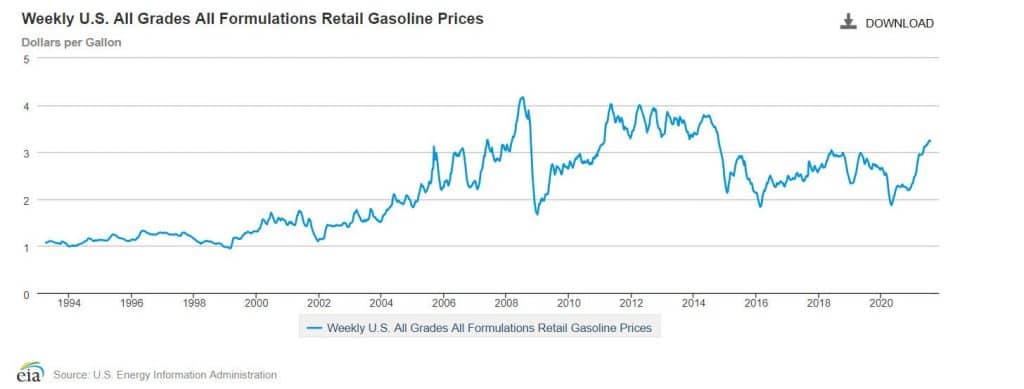

- We have written a lot on total cost of ownership over the last few years, but that is a fancy way of saying you can expect to save about $10,000 over 5 years (and $20,000 over 10 years) compared to ownership of a gas-powered crossover with similar space and much slower performance, thanks to lower fuel and maintenance costs. The chart above shows that gas prices in the US have gone up 38% since January 1st, making these savings go up substantially this year. Gas prices are already high in most of the world’s developed countries. In contrast, the EIA predicts electricity prices in the US will only go up 2.8% for the entire year.

- At some point, the longevity story will become a thing (that Tesla cars can be used about twice as long as gas cars without high repair costs). The only update on this is Tesla did mention that the 4680 cells had been validated to have a long life in vehicles in response to a question on the conference call. I still think it will take years for that record to get out there and it to be publicized by articles like this one.

Conclusion

This chart recently tweeted by James Stephenson shows graphically what Tesla CTO Zachary Kirkhorn said on the call, and that I mentioned as a new demand lever. Tesla’s progress since 2018 is amazing. It has been able to increase its gross margin by 7.2% while reducing average selling prices by about 44%. Compare this to the rest of the US auto industry, which increased prices by 9.4% according to statista.com (2018 to 2020, even before the recent spike) and has gross margins about half of Tesla’s (after reviewing recent Ford, GM, and Stellantis gross margins).

This stark contrast in healthy margins based on cost controls and engineering even while reducing vehicle prices gives Tesla room to maneuver in the event that competitive pressure or other headwinds appear. It also shows that Tesla has a unique proven ability to reduce the cost of its vehicles by using manufacturing engineering. Can you name another automotive company that has been so successful at reducing costs?