- 💰 Tesla has reduced the prices of its vehicles in multiple key markets around the world, following the price cuts in the U.S. last week.

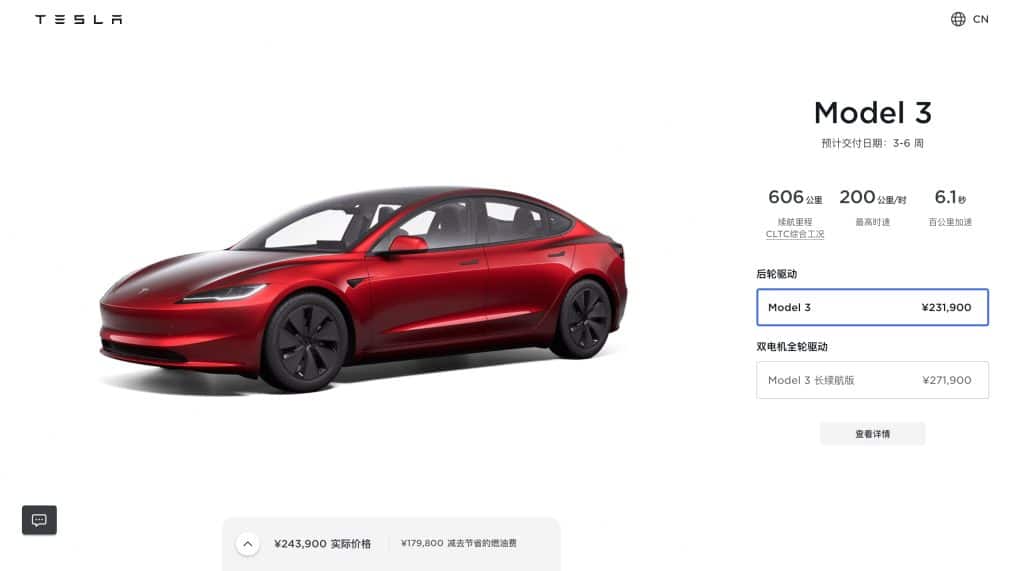

- 🇨🇳 In China, Tesla reduced the price of the rear-wheel-drive Model 3 to 231,900 yuan (~$32,013), a drop of 14,000 yuan (~$1,933).

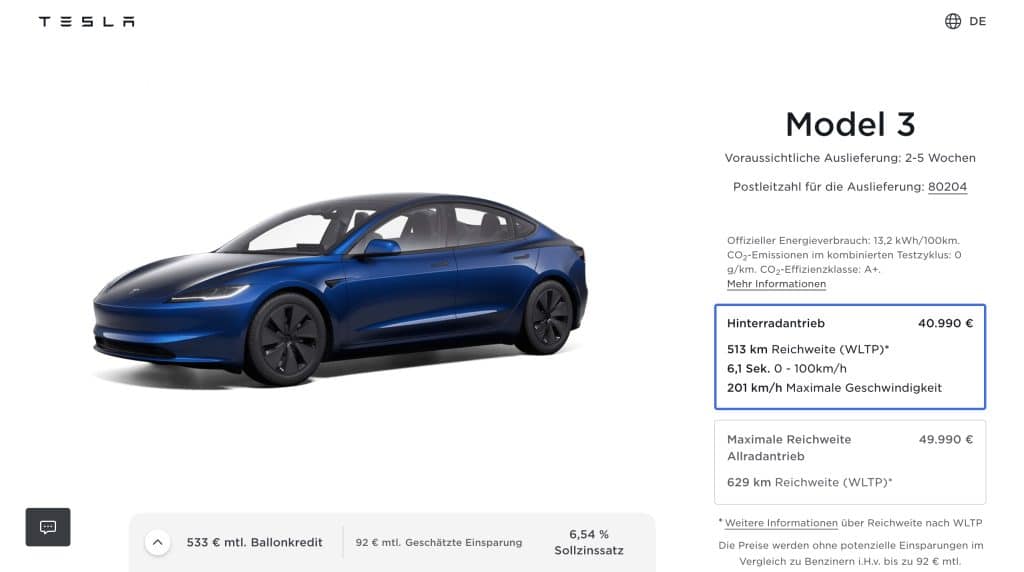

- 🇩🇪 In Germany, the price of the Model 3 rear-wheel-drive was cut to 40,990 euros (~$43,650) from 42,990 euros (~$45,780).

- 🌍 Price cuts were also implemented across other European, Middle Eastern, and African countries, following previous reductions in those markets a couple of months ago.

- 🗣️ Elon Musk commented that Tesla’s pricing strategy is focused on matching production with demand.

- ⏱️ The price cuts come ahead of Tesla’s Q1 2024 earnings call on Tuesday, where various topics, including delivery and production results, Musk’s compensation package, and the upcoming Robotaxi unveil, are expected to be discussed.

In a bold move that reverberated across the automotive industry, Tesla has implemented significant price reductions for its vehicles in multiple key markets around the world. Following the recent price cuts in the United States, the electric vehicle (EV) giant has now extended this strategy to regions such as China, Germany, and other European, Middle Eastern, and African countries.

Matching Production and Demand

The rationale behind Tesla’s global price adjustment strategy is straightforward yet crucial: aligning production with demand. As confirmed by Elon Musk himself, this pricing approach is designed to ensure that the company’s manufacturing output is in sync with consumer demand, thereby optimizing sales and maintaining a healthy balance between supply and demand.

By reducing prices in major markets like China and Germany, where Tesla has established Gigafactory locations, the company aims to stimulate consumer interest and drive up sales volumes. This move acknowledges the evolving competitive landscape and the need to remain agile in adapting to market dynamics.

Competitive Edge in Key Markets

China, in particular, has emerged as a battleground for EV manufacturers, with domestic and international players vying for market share. Tesla’s decision to cut the price of the rear-wheel-drive Model 3 to 231,900 yuan ($32,013), a reduction of 14,000 yuan ($1,933), demonstrates the company’s commitment to maintaining a competitive edge in this crucial market.

Similarly, in Germany, Tesla has reduced the price of the Model 3 rear-wheel-drive to 40,990 euros ($43,650) from 42,990 euros ($45,780). This strategic move aims to bolster Tesla’s position in the European market, where competition from established automakers and emerging EV startups is intensifying.

A Global Pricing Realignment

Tesla’s price cuts are not confined to the U.S., China, and Germany alone. The company has also implemented price reductions across other European, Middle Eastern, and African countries, building upon previous pricing adjustments made in these regions a couple of months ago.

This global pricing realignment underscores Tesla’s commitment to maintaining a competitive edge and ensuring that its products remain accessible to consumers worldwide. By adapting its pricing strategy to local market conditions, Tesla is better positioned to capture a broader customer base and solidify its position as a leader in the EV revolution.

Anticipating the Q1 2024 Earnings Call

The timing of these price cuts is particularly intriguing, as they come just ahead of Tesla’s highly anticipated Q1 2024 earnings call scheduled for Tuesday. During this pivotal event, investors and analysts will be closely monitoring Tesla’s performance, seeking insights into the company’s delivery and production results, as well as its plans for the future.

One of the key topics expected to be discussed is Elon Musk’s 2018 compensation package, which is set for a shareholder vote. Additionally, the highly anticipated unveiling of Tesla’s dedicated Robotaxi, slated for August 8, 2024, is likely to be a focal point of discussion, as the company aims to revolutionize the transportation industry with its autonomous ride-hailing service.

A Strategic Balancing Act

Tesla’s global price adjustment strategy represents a delicate balancing act between maintaining profitability, driving sales, and positioning the company for long-term success. By reducing prices, Tesla aims to stimulate demand and capture a larger share of the EV market, but this move also carries the risk of potentially eroding profit margins in the short term.

However, Elon Musk’s willingness to embrace bold pricing strategies underscores his vision and commitment to Tesla’s long-term goals. By aligning production with demand and maintaining a competitive edge, Tesla is better positioned to navigate the rapidly evolving EV landscape and capitalize on emerging opportunities.

Looking Ahead: Robotaxi and Beyond

As Tesla prepares for the highly anticipated unveiling of its dedicated Robotaxi, the company’s pricing strategy takes on even greater significance. The success of this autonomous ride-hailing service will depend not only on technological advancements but also on consumer adoption and affordability.

By maintaining competitive pricing and fostering a strong demand for its vehicles, Tesla can leverage its brand recognition and innovative spirit to position itself as a frontrunner in the Robotaxi revolution. This endeavor holds the potential to disrupt the transportation industry and usher in a new era of mobility, where convenience, sustainability, and cutting-edge technology converge.

As the Q1 2024 earnings call unfolds, Tesla’s global price adjustment strategy will undoubtedly be a topic of keen interest. Investors and industry analysts will scrutinize the company’s performance, seeking insights into the effectiveness of this pricing approach and its implications for Tesla’s future growth trajectory.

In the ever-evolving landscape of the automotive industry, one thing is certain: Tesla’s willingness to embrace bold strategies and challenge conventions has been a driving force behind its success. As the company navigates the challenges and opportunities ahead, its global pricing realignment serves as a testament to its adaptability and commitment to staying ahead of the curve.