Key Points

- 💰 Analyst Mark Delaney predicts Tesla’s Full Self-Driving (FSD) suite could generate billions in revenue annually by 2030.

- 📈 Tesla stock (TSLA) has seen a 14% increase in the past week, with optimistic investors anticipating continued growth.

- 🚗 Tesla’s potential growth factors include the mass-market $25,000 car, FSD licensing, and revenue from Tesla EV buyers adding the FSD suite.

- 🌐 FSD aims to transform passenger transportation, allowing cars to operate as Robotaxis, potentially earning owners tens of thousands of dollars yearly.

- 💻 Tesla’s software-related revenue, mainly from FSD, could reach tens of billions of dollars per year by 2030, according to Delaney.

- 💡 Delaney suggests Tesla could become a software company by selling or licensing its FSD software, contributing to a revenue range of $315 billion to $625 billion.

- 📉 Potential downsides include steeper price reductions, impacting margins, profitability, and the risk of delays or issues with FSD development.

Tesla’s Full Self-Driving suite could potentially be worth billions of dollars a year in revenue by the end of the decade. That’s what Mark Delaney of Goldman said in a note to investors, as the analyst put his own synopsis of what the FSD suite could achieve for shareholders moving forward.

Tesla stock (NASDAQ: TSLA) has already had a good week, and is up nearly 14 percent over the past five trading days.

Although shares of the EV maker’s stock have ballooned 912 percent over the past five years, permabulls and true believers of Elon Musk and Tesla have said that they have no intentions of selling their shares, all because they believe more monumental growth is coming in the next few years.

Scaling EV sales through new projects, like the mass market $25,000 car that will be available in several markets, the licensing of FSD, and even the revenue that will come from car buyers that opt to add the suite to the purchase of their Tesla EV, are all factors in this potential growth. Tesla is already eyeing up its next Gigafactory location, and there are several highly attractive candidates.

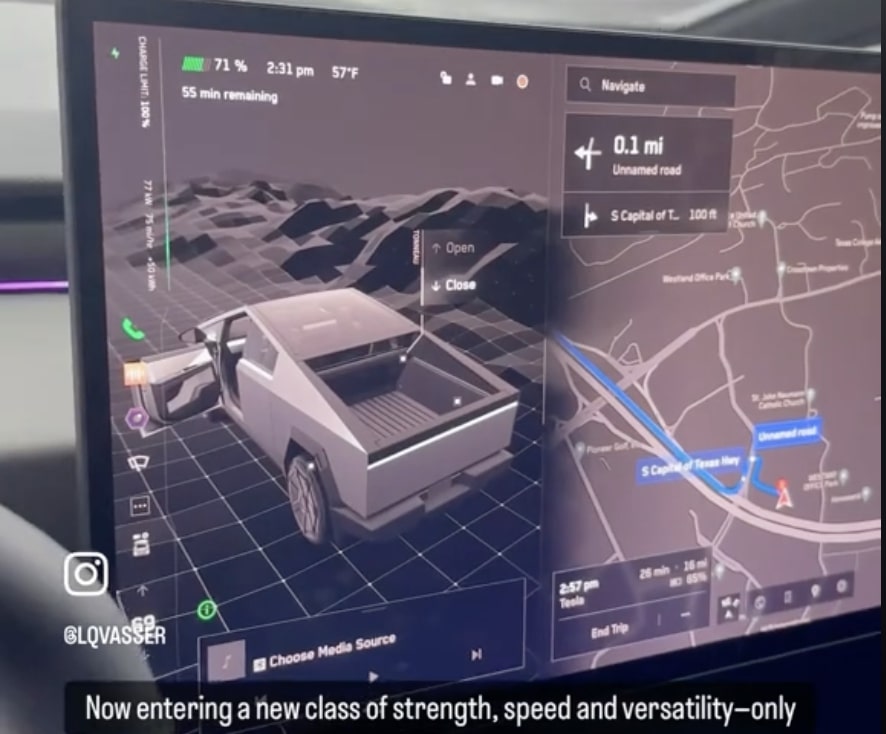

But while production increases are expected, the true growth could come from the FSD suite, which Tesla plans to use to transform and revolutionize passenger transportation.

Not only will drivers be able to have their cars drive them to their destinations, but they will also be able to make tens of thousands of dollars per year by having their car operate as a Robotaxi, enabling a money-making ridesharing service that brings home the bread while the car owner sleeps.

Delaney’s synopsis of FSD and what it could do for Tesla’s balance sheet by the end of the decade is simple and outlines an explicit path to more revenue for the company (via Yahoo!):

“We believe that Tesla’s software-related revenue could be tens of billions of dollars per year by 2030 (mostly from FSD). These scenarios suggest that in an upside case FSD could account for tens of billions of revenue per year (and more if we consider licensing of Dojo or selling FSD to other OEMs).”

As a business, Tesla operates an automotive and energy division, but selling or licensing its FSD software would make it a software company as well if it already is not considered one on the developments of FSD and how it handles data from its vehicles.

On the high end, Tesla could bring in $625 billion in revenue from vehicles, software, energy, and services. On the low end, Delaney and Goldman believe $315 billion is accurate.

“This [auto sales] could account for ~$525-600 bn of revenue. We believe services could be >$150 bn as Tesla’s installed base grows (and from opening its charging network and insurance). We believe energy, software, and robotics would make up the balance (or provide upside),” Delaney also wrote in the note.

In terms of downside, Tesla does face steeper price reductions over the coming years, which would squeeze margins and affect profitability. Additionally, product delays, including the potential of issues developing FSD, could cost Tesla some of this revenue.