- 💼 Ford CEO Jim Farley’s total compensation increased by as much as 26 percent in 2023.

- 💰 Farley’s total compensation in 2023 was nearly $26.5 million, up substantially from under $21 million in 2022.

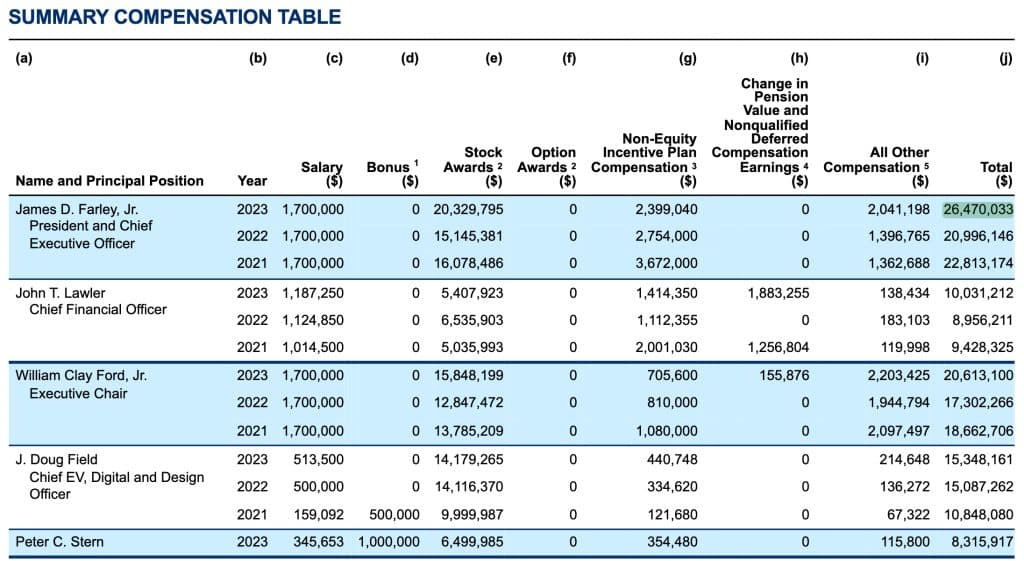

- 📈 Farley’s salary was approximately $1.7 million, complemented by stock awards of $20.3 million, a non-equity incentive plan compensation of almost $2.4 million, and other compensation of around $2 million.

- 🚗 The pay raise news follows historic six-week strikes from the United Automotive Workers (UAW) union in 2023, sparking criticism of corporate greed.

- 🌍 Stellantis CEO Carlos Tavares received a total compensation of 36.5 million euros ($39.5 million) in 2023, up more than 55 percent, while GM CEO Mary Barra earned around $28.98 million in 2022.

- 🔌 Ford announced plans to cut the F-150 Lightning production workforce by about two-thirds as it shifts focus towards mass-market, affordable electric vehicles (EVs).

- ⚡ Ford EVs now have access to the Tesla Supercharger network in North America, expanding charging options for owners.

In the world of corporate compensation, few things capture attention quite like a significant pay raise for a CEO. Recently, Ford made headlines as it revealed that CEO Jim Farley experienced a substantial increase in his total compensation in 2023. Let’s delve into the details, analyze the implications, and explore the broader context of this development.

Breaking Down the Numbers

- Percentage Increase: Farley’s total compensation surged by as much as 26 percent in 2023. This is a notable jump, especially considering the economic landscape and prevailing sentiments around executive pay.

- Dollar Figures: The numbers speak volumes. Farley’s total compensation reached nearly $26.5 million in 2023, marking a significant uptick from the previous year’s figure of under $21 million.

- Composition of Compensation: Understanding where this compensation comes from is crucial. Farley’s salary forms a part of it, amounting to approximately $1.7 million. However, the lion’s share comes from stock awards, totaling $20.3 million. Additionally, he received a non-equity incentive plan compensation of almost $2.4 million, along with other compensation of around $2 million.

Contextualizing the Pay Raise

- Union Strikes: It’s essential to view this pay raise in light of recent events. The historic six-week strikes by the United Automotive Workers (UAW) union in 2023 have undoubtedly influenced the narrative surrounding executive compensation. Critics have pointed to these strikes, framing Farley’s raise as a move driven by corporate interests amidst labor disputes.

- Comparison with Peers: Benchmarking against peers provides context. While Farley’s compensation increased substantially, it’s intriguing to note the figures for CEOs of other major automakers. For instance, Stellantis CEO Carlos Tavares saw a total compensation of 36.5 million euros ($39.5 million) in 2023, up more than 55 percent. Meanwhile, GM CEO Mary Barra earned around $28.98 million in 2022, setting a high bar for executive compensation in the industry.

The Broader Industry Landscape

- Strategic Shifts: Ford’s decision to cut the F-150 Lightning production workforce by about two-thirds signifies a strategic pivot towards mass-market, affordable electric vehicles (EVs). This move aligns with broader industry trends towards sustainability and innovation.

- Charging Infrastructure: Ford EV owners now have access to the Tesla Supercharger network in North America. This collaboration expands charging options, addressing a crucial aspect of EV adoption—charging convenience.

Conclusion: Insights and Reflections

Ford CEO Jim Farley’s significant pay raise underscores the complexities of executive compensation, particularly within the automotive industry. While the numbers may seem staggering, they are reflective of broader market dynamics, strategic decisions, and ongoing labor relations. As stakeholders, it’s essential to scrutinize such developments critically, considering their implications for corporate governance, employee welfare, and industry competitiveness.