In 2020, almost 90% of the batteries deployed by Panasonic in passenger xEVs went to Tesla.

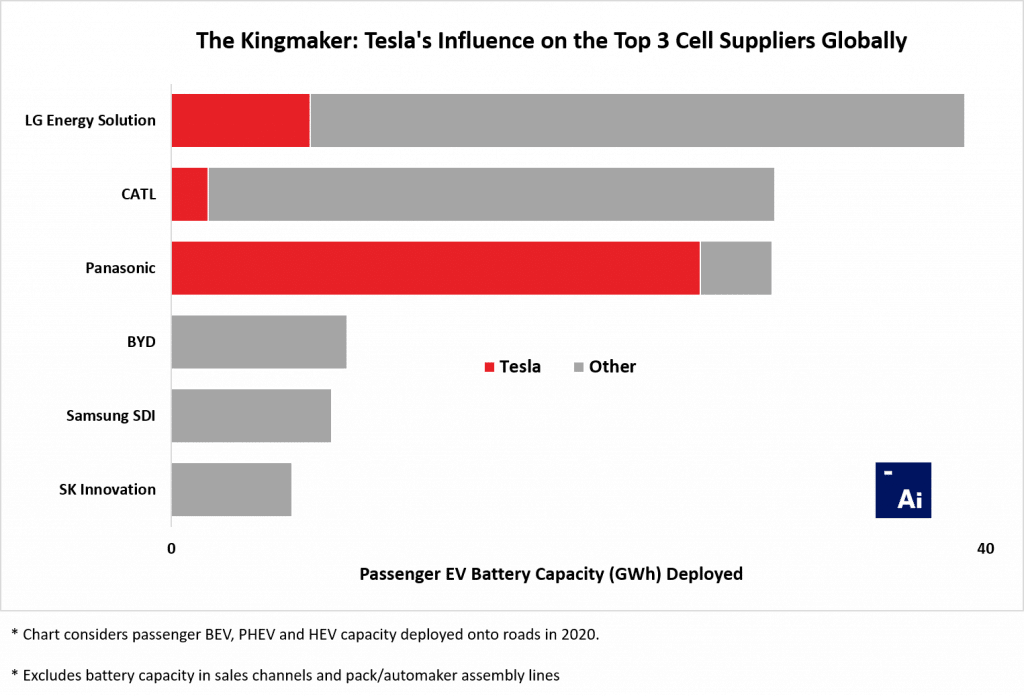

Here is Adamas Intelligence’s very interesting study on the impact of Tesla on the xEV battery cell market in 2020 (total of 134.5 GWh) – specifically on the top three battery suppliers (LG Chem’s LG Energy Solution, CATL and Panasonic).

As we know from the sales figures, Tesla is the world’s largest producer of electric cars (even if we include plug-in hybrids), and Tesla is also the largest player in terms of battery deployment – power (GWh) and battery materials for passenger xEVs (BEVs, PHEVs, HEVs), according to Adamas Intelligence. In addition, Tesla is bigger than the next few producers combined!

“In 2020, Tesla outsold all other plugin electric vehicle makers globally and deployed more passenger xEV battery capacity and battery materials, namely lithium, nickel and graphite, than its four closest competitors combined.”

Panasonic (NCA chemistry), LG Chem’s LG Energy Solution (NCM 811 chemistry) and CATL are Tesla’s (at least the largest and officially known) battery providers (LFP chemistry). For the Made-in-China (MIC) Model 3/Model Y, the last two entered the group in 2020 to supply cells.

The main map, compiled by Adamas Intelligence, shows how its suppliers are affected by Tesla. Before we go into details, just take a look at how dependent Panasonic’s battery business is on Tesla:

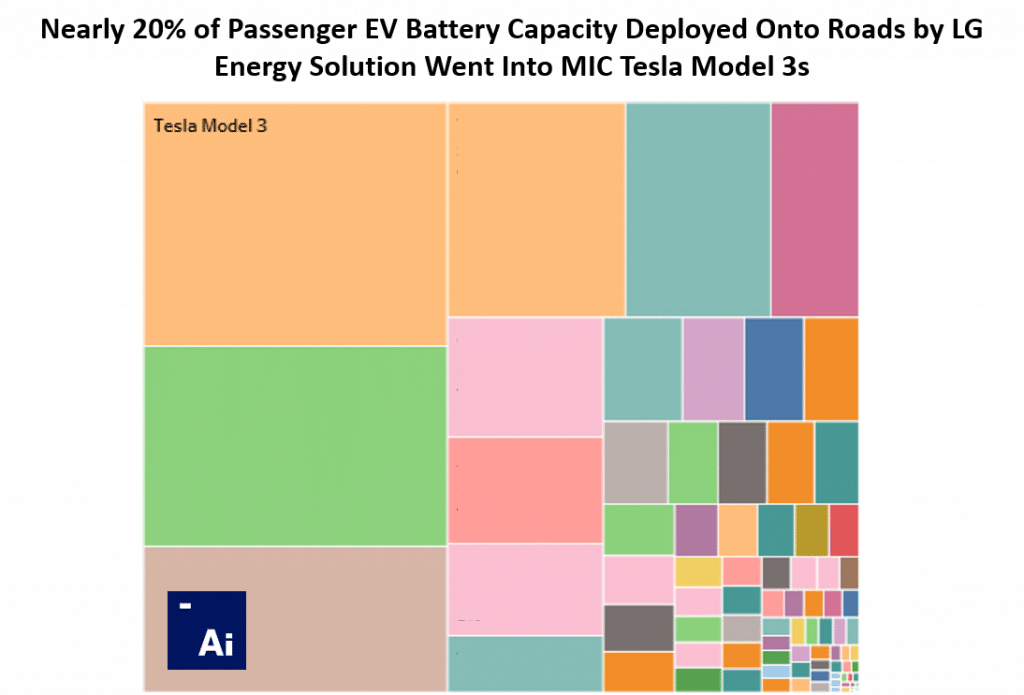

LG Chem’s LG Energy Solution

The South Korean company is the largest global producer of lithium-ion cells for passenger xEVs, with approximately 38 GWh likely to be installed in cars sold in 2020.

It looks very healthy for LG Energy Solution. Production is rising, consumer reach is geographically diversified, there are a large number of different consumers, and the battery industry is profitable.

Tesla represents nearly 20 percent of the xEV battery sales of LG Energy Solution, according to the latest survey. That’s still enough, though, to recognize MIC Model 3 as the company’s largest project.

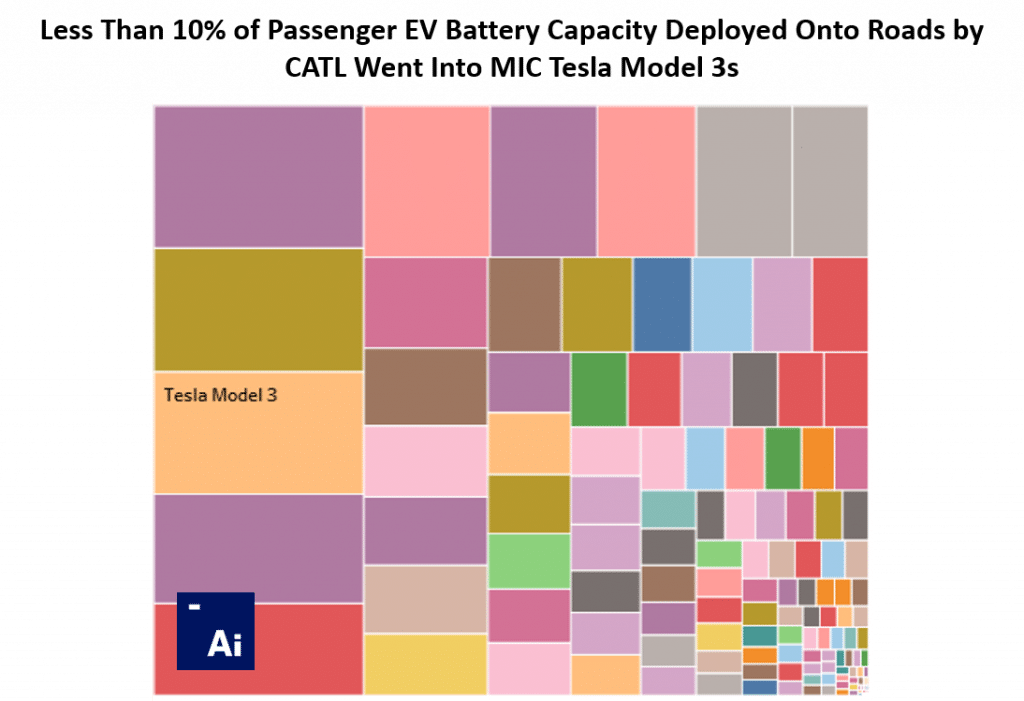

CATL

In terms of the number of customers/cars, Chinese CATL is much more diversified, but concentrated mainly in China.

The MIC Model 3 was launched late in 2020 with CATL batteries. This is why it’s responsible for less than 10% of the volume.

“In 2020, less than 10% of all passenger EV battery capacity deployed onto roads by CATL went into MIC Tesla Model 3s, making it the cell supplier’s third greatest ‘vehicle’ to market for the calendar year, albeit the fastest growing customer on CATL’s books. Deliveries of CATL-supplied Tesla Model 3s to customers only started in Q4.”

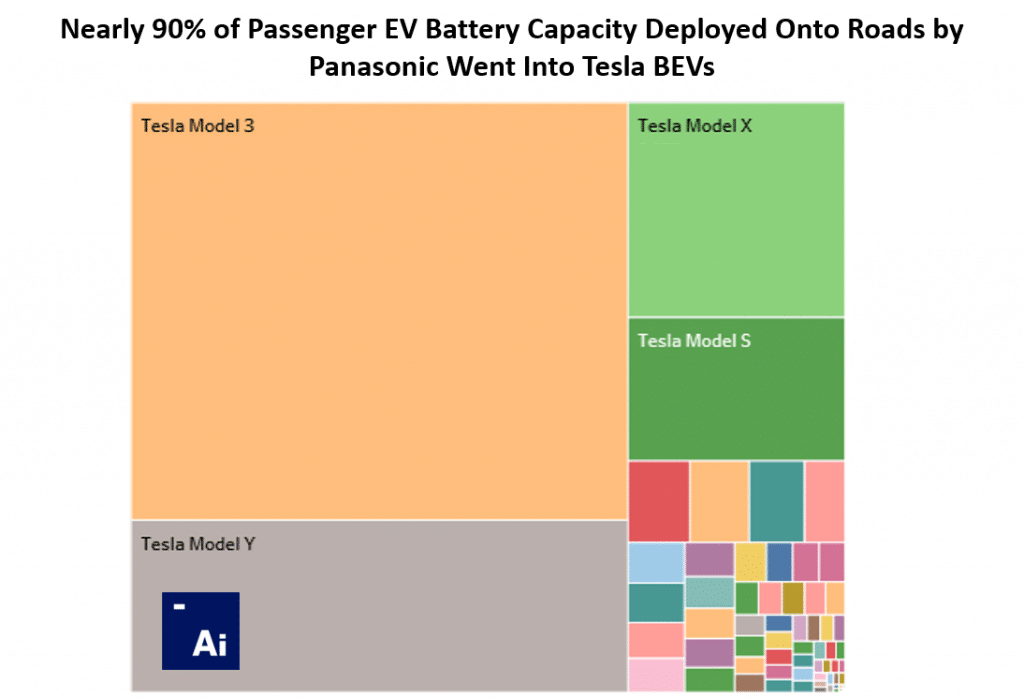

Panasonic

And here’s Panasonic, Tesla’s long-standing supplier of lithium-ion cells for all models, which has been an exclusive partner for a long time.

The Japanese company is still Tesla’s most significant battery partner, the largest volume supplier, involved in all the cars on the market, and a manufacturing partner at the Tesla Gigafactory in Nevada.

Tesla, however, is responsible for nearly 90 percent of Panasonic’s overall deployment of passenger xEV battery power.

“Moreover, in 2020, nearly 90% of all passenger EV battery capacity deployed onto roads by Panasonic went into Tesla battery electric vehicles of all kinds, making it by far and large the cell supplier’s widest channel to market for the calendar year.”

Panasonic sells xEV batteries at a profit, but from the market viewpoint, such high dependency on a single customer who, by the way, buys a particular battery format (18650 or 2170), not used by any other customers, sounds risky. However, a deal with Toyota (possible large client) could strengthen the balance.

Ready to join Tesla’s Mission to accelerate the world’s transition to sustainable energy? Feel free to use my referral code to get some free Supercharging miles with your purchase: http://ts.la/guanyu3423

You can also get a $100 discount on Tesla Solar with that code.