- 🚀 Tesla shares surged nearly 15% after Trump’s predicted White House victory, as investors anticipate benefits for CEO Elon Musk.

- 🇺🇸 Elon Musk, a Trump supporter, donated $75 million to support the Republican nominee.

- 🏛 Trump promised Musk a role in a government efficiency commission if elected.

- 💼 Despite Trump’s generally negative stance towards clean energy, Tesla’s unique position could benefit from a non-EV subsidy environment and higher China tariffs.

- 📉 Tesla has underperformed the broader market this year, despite the recent surge in stock prices.

In a surprising turn of events, Tesla shares have soared nearly 15% following the anticipated victory of Donald Trump in the White House elections. This surge is not just a typical market fluctuation but a result of strategic moves and political engagements orchestrated by Tesla’s CEO, Elon Musk. Let’s explore how this situation unfolds, its implications for Tesla and the broader electric vehicle (EV) industry, and what might lie ahead.

The Political Leap: Musk’s Strategic Move

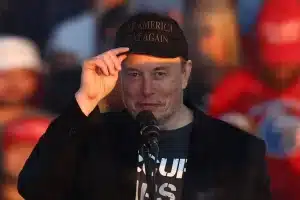

At the heart of this financial uptick is Elon Musk, who not only leads Tesla but has shown active political involvement. Musk, a prominent Trump supporter, has invested heavily in the political landscape. His donation of $75 million to support the Republican nominee indicates a calculated risk aimed at reaping potential benefits under a Trump presidency. The investment seems to be paying off, with Tesla’s shares reflecting positive investor sentiment.

Political Promise and Market Perception

Trump’s promise to appoint Musk to a government efficiency commission if elected provides further fuel for investor optimism. This potential role aligns with Musk’s known efficiency-driven mindset and could herald significant fiscal policies affecting Tesla’s operations and the broader market. For investors, such developments are indicators of a favorable business environment where regulatory processes may skew in favor of firms like Tesla.

Navigating Non-EV Subsidies and Tariffs: A Tesla Advantage

Despite Trump’s historical ambivalence toward clean energy, Tesla stands at a crossroads with unique advantages. The potential removal of EV subsidies may initially appear detrimental, yet Tesla’s scale, brand strength, and innovation place it in a position to thrive. Furthermore, Trump’s inclination towards implementing higher tariffs on Chinese imports might restrict cheaper EV models from entering the U.S. market, offering Tesla a competitive edge.

A Year of Mixed Performance

While the recent surge paints a rosy picture, Tesla’s stock has underperformed compared to the broader market throughout the year. With a minimal yearly gain versus the significant rise seen in the S&P 500, Tesla’s market journey leans towards volatility. This performance is partly influenced by fluctuating market conditions and external economic factors, posing a broader question of sustainability regarding such spikes in stock value.

The Future of Tesla and the EV Industry Under Trump

1. Impact of Political Dynamics

Tesla’s current trajectory raises questions about the intersection of politics and business. As seen with Musk’s involvement, strategic political ties may become crucial for large corporations navigating future regulations.

2. Elon Musk’s Growing Influence

Musk’s political contributions highlight a growing trend among major business leaders seeking to influence policy and market dynamics. This raises questions about the ethical and business implications of such engagements.

3. Prospects for the EV Industry

The potential policy shifts under Trump’s administration could redefine the competitive landscape for EVs. A focus on American jobs and industry re-shoring may lead to increased domestic EV production and innovation.

In Conclusion

Elon Musk’s adept navigation of political frameworks combined with Tesla’s strategic positioning marks a pivotal moment in the company’s history. Whether through investing in political initiatives or advancing technological innovation, Tesla’s journey illustrates the intricate balance between business acumen and market dynamics. As political winds shift, the evolution of Tesla and the broader EV sector will be closely watched by investors, policymakers, and the public alike.