Key Points

- 💼 Tesla’s Q3 2023 Earnings Call has led to a cautious outlook from analysts regarding the company’s stock.

- 📉 Some analysts have lowered their 12-month price targets for Tesla due to CEO Elon Musk’s cautious tone during the call.

- 🌱 Long-term Tesla supporters remain optimistic about the company’s growth, particularly in autonomy, AI, and cell production.

- 🌊 Musk acknowledges challenges ahead, including high-interest rates and delays in Cybertruck production.

- 📉 Wedbush’s Dan Ives referred to the call as a “mini disaster” and lowered their price target for Tesla.

- 💰 Morgan Stanley’s Adam Jonas also adjusted their price target down, raising concerns about the company’s growth.

- 🚗 Model Y is performing well, Autopilot has driven over 500 million miles, and energy storage is robust.

- 📆 First Cybertruck deliveries are scheduled for November 30.

- 🌍 Analysts advise caution as Tesla faces challenges in the coming year due to global economic conditions.

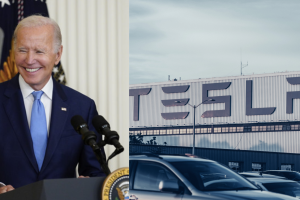

Tesla (NASDAQ: TSLA) Earnings tempered analyst outlooks on the electric automaker’s stock as one firm referred to the call as a “mini disaster,” and another questioned whether shares could be looked at from a growth perspective as CEO Elon Musk advised investors that the company would take a cautious attitude toward the future with uncertain macroeconomic conditions.

Tesla’s Q3 2023 Earnings Call was one of the most cautious and perhaps worrisome in years as the automaker admitted high-interest rates and future projects could yield what would be looked at as less-than-favorable for short-term investors.

Long-term Tesla permabulls could not be shaken from their firm stance that the company is set for monumental growth moving forward, and how could they? Musk continued to speak positively about overall growth for Tesla in terms of autonomy, AI, and cell production.

However, analysts are adjusting their 12-month price targets on the stock as Musk’s tone during the call was cautious and aware of the rough waters that lie ahead.

“I’m not saying things will be bad. I’m just saying they might be,” Musk said during the Call. “And I think like Tesla is an incredibly capable ship, but we need to make sure like as…if the macroeconomic conditions are stormy, even if the best ship is still going to have tough times. The weaker ships will sink.”

Musk acknowledged the rough waters that likely lie ahead for the Tesla ship, and waves will consist of high-interest rate environments, which will temper demand for its vehicles as consumers struggle to keep up with inflation and lengthy waits for Cybertruck to contribute positive cash flow for the company.

“We have seen the highest highs and some very challenging times from Tesla and Musk over the last decade, with last night’s quarter and conference call not an inspiring one for the bulls,” Wedbush’s Dan Ives wrote in a note.

“In a nutshell, we would characterize last night’s conference call as a ‘mini disaster’ as the Street wanted to get their arms around the falling margins and constant price cuts seen globally, but instead, we heard from a much more cautious Musk which focused on higher interest rates, FSD/AI investments, and highlighting the difficult path for Cybertruck production over the next 12 to 18 months.”

Ives pushed Wedbush’s price target on Tesla down to $310 from $350, citing a “more cautionary near-term dynamic for Musk & Co.”

Adam Jonas of Morgan Stanley shared similar sentiments, adjusting his price target from $400 to $380.

“How can we be overweight [on] Tesla despite the company’s caution on macro, consumer, Cybertruck and Mexico? Can a ‘growth stock’ work if earnings don’t grow in 2024?” he wrote.

Jonas and fellow Morgan Stanley associates characterized the call as “one of the most cautious Tesla conference calls we’ve heard in years.”

Musk announced that not only would Cybertruck confront Tesla with “enormous challenges” in terms of the initial production ramp and becoming cash flow positive, but that Gigafactory Mexico won’t be a “full tilt” effort until the global economic outlook becomes more stable.

It was not all bad. Model Y is trending to be the best-selling car in terms of revenue and unit value, Autopilot has driven over 500 million miles with Full Self-Driving beta, and energy storage was robust for the quarter. Cybertruck even got a date for the first deliveries, November 30.