I just saw Mercedes-Benz announce that it sold 590,999 passenger cars (+22.3%) in the 1st quarter of 2021. It got me thinking about the growth potential for Tesla, which is often lumped in with Mercedes, BMW, and Audi as a premium-class brand. I went and found Audi’s and BMW’s latest releases on quarterly global sales as well. Audi scored a record 505,583 sales in the 4th quarter of 2020. (Its Q1 2021 sales figures are not in yet.) And BMW Group just had its own record, with 636,606 1st quarter sales being its best 1st quarter in history. That covers BMW, MINI, and Rolls-Royce. Just looking at the BMW brand, it had 560,543 global sales in the quarter, almost equally between its two top rivals (Mercedes and Audi).

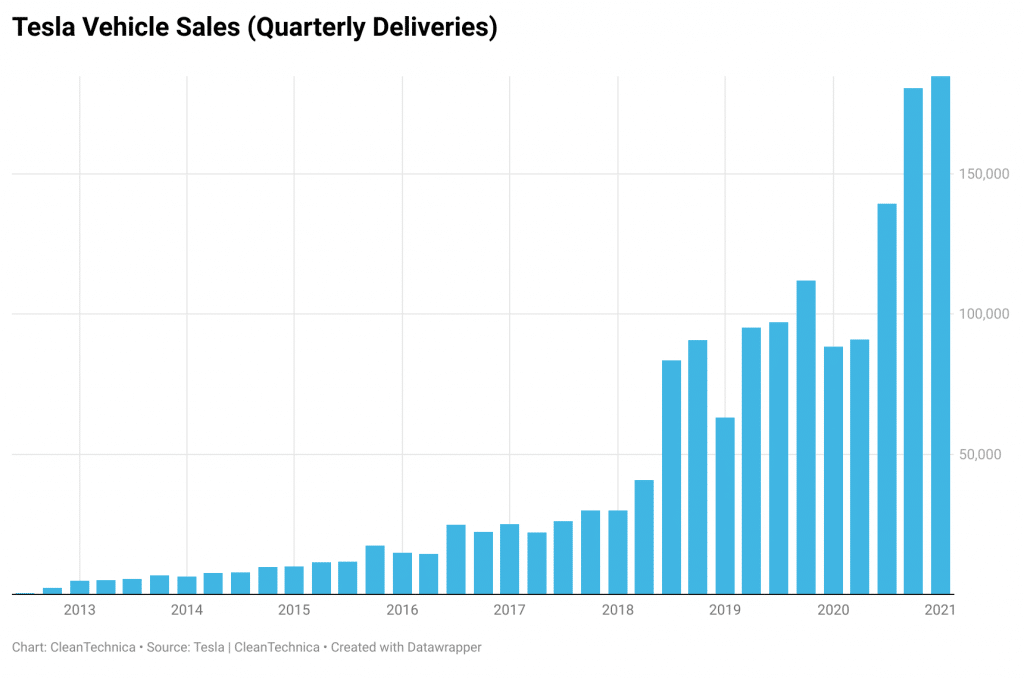

Tesla had 185,000 deliveries in the 1st quarter of 2021. My first thought when seeing the Mercedes numbers above was that Tesla sales could double or even triple and still not reach that level, which means there’s still a lot of room for Tesla growth, especially considering that Tesla vehicles offer a lot more for the money than Mercedes vehicles (in my opinion, that’s a fact). That thought was linked to the thought that any concerns about Tesla consumer demand should fade away or be proven pointless as Tesla climbs to Mercedes levels. It may take time for word of mouth to spread to that level, but looking at how fast Tesla sales have grown, it’s hard to see it as a true concern.

However, then I started thinking more about Full Self-Driving (FSD), Tesla infotainment, and Elon Musk’s goal of getting to 20 million vehicles a year by 2030, approximately double Volkswagen Group’s and Toyota’s level.

As I considered whether or not to write about this, I realized that the key point is there could be vastly different growth paths for Tesla, and the interesting thing might be mapping those out a little.

First of all, note that Tesla still has a lot of room for geographic expansion — India, Brazil, South Africa, and various Middle Eastern and European countries are several notable markets where Tesla should be able to sell a decent number of Model 3 and Model Y vehicles, especially as more vehicle factories are built (Texas could supply South America, Berlin could supply much more of Europe better). It is not selling in those places yet because it has plenty of demand in existing markets.

Just with its current tech and word of mouth, it’s hard to imagine Tesla can’t match or beat premium-class competitors like BMW, Mercedes-Benz, and Audi in the next few years. We can consider that the bearish scenario — half a million quarterly sales by 2025 and a million quarterly sales by 2030. Yes, that’s a very bearish forecast compared to Tesla’s goals and fan expectations, but let’s just put it there as a placeholder assuming Tesla struggles with full autonomy and struggles trying to expand its market offerings beyond the classes it’s in right now.

Another major possibility is that Tesla could nail FSD, start putting robotaxis on the road, and see consumer demand (aka sales) skyrocket. If Tesla vehicles get regulatory permission to drive themselves, and no other automobiles on the market can do that for a broad geography for some years, then Tesla will clearly have as much demand as it can possibly serve. Sales will be a matter of Tesla production capacity indefinitely. If that’s the case, Elon Musk’s goal of reaching 20 million vehicles a year by 2o30 is simply a matter of battery supplies and production capacity growth — and Tesla may well make it happen.

But let’s step back another level. Let’s say Tesla can’t get FSD to the point where you can bring your pillow and sleep in the car after watching a movie on Netflix rather than driving. Tesla’s still got another trick up its sleeve. It’s working on a smaller, more affordable electric car, which we’re calling the “Model 2” for now (just as a placeholder, but I’ll come back to that later today to explain why Tesla will be required to use that name). When you go down the automotive price curve, consumer demand doesn’t increase linearly as more people are able to afford the car, it increases exponentially (or something like that). Just as the $39,000+ Model 3 expanded Tesla’s market enormously and made sales of the Model S and Model X look like peanuts in comparison, the Model 2 would serve an even larger market. It would be a mass-market car to an extent the Model 3 can only dream of. In this scenario, how high could Tesla go?

Elon Musk is not keen on being put in boxes, and that goes for one of his babies, Tesla, too. Whereas BMW, Audi, and Mercedes feel compelled to stay in their lanes and not offer affordable cars, Tesla seems headed in that direction. After all, Tesla’s aim is not to become a top luxury automaker — it’s to accelerate the transition to sustainable energy (which in the transport sector means accelerating the adoption of electric vehicles). The Model 2 wouldn’t be competing against the BMW 3/4 Series. It would be competing against the high-volume Honda Civic and Toyota Corolla. A Model 3–like car that is a bit smaller and has a bit less range would sell at very high levels. Better tech (Netflix, YouTube, games, good basic semi-autonomous driving functions), better performance, better safety, better handling, a smoother drive, and convenient home charging; a Model 2 could take a nice chunk of the Civic and Corolla market. This model could raise Tesla’s sales level well beyond that of its luxury competitors. When you consider the huge “super margins” Tesla may be achieving from its Shanghai gigafactory, the idea becomes particularly compelling.

How much demand would there be for a $25,000 Tesla with many of the same benefits of the Model 3? How much demand will there be for the Model Y and Model 3 at a steady state? How about the Cybertruck?

Elon’s target is essentially 5 million vehicles a quarter by the end of 2030. Audi was at 1/10 of that number at the end of 2020, and BMW and Mercedes just a bit higher. No auto brand was close to 5 million on its own. Pre-pandemic, in 2019, Toyota was at nearly 10 million annual sales (9,714,253). That’s ~2.4 million a quarter. Does Tesla’s combo of premium-class tech at a forecasted lower cost have what it takes to get to 5 million a quarter? Does it have what it takes, with or without FSD, to get to 2 to 4 million a quarter? Further, each step along the path, what will its sales be? Here’s one possible path that I think I see used or cited the most (all are annual sales forecasts):

- 2022 — 1 million

- 2023 — 1.5 million

- 2024 — 2 million

- 2025 — 3 million

- 2026 — 4.5 million

- 2027 — 6 million

- 2028 — 9 million

- 2029 — 12 million

- 2030 — 18 million

However, that leaves some big questions. What are the model splits in that forecast? Which new models will Tesla introduce to expand its market appeal, or will it use more of an Apple approach whereby the customization is primarily in the software? If the latter, does that really work in the auto market, where so much of a car’s appeal is its identity and how that links to your identity?