Key Points

- 📉 Tesla was the most shorted stock in the Americas in August.

- 📊 Data from Hazeltree, a treasury and liquidity management solutions firm, reveals Tesla’s continued popularity among short sellers.

- 📈 Despite past losses, short sellers are still betting against Tesla.

- 🌎 Tesla remains the most shorted stock in the “large-cap category” in the Americas.

- 🏢 Institutional supply utilization for Tesla is low, with short positions primarily from individual investors.

- 📆 Over the past three months, Tesla’s institutional supply utilization has decreased.

- 🚗 Rivian also has high institutional supply utilization, indicating significant short interest from institutions.

- 💰 Tesla’s stock surged 10 percent recently, contributing to its increased value.

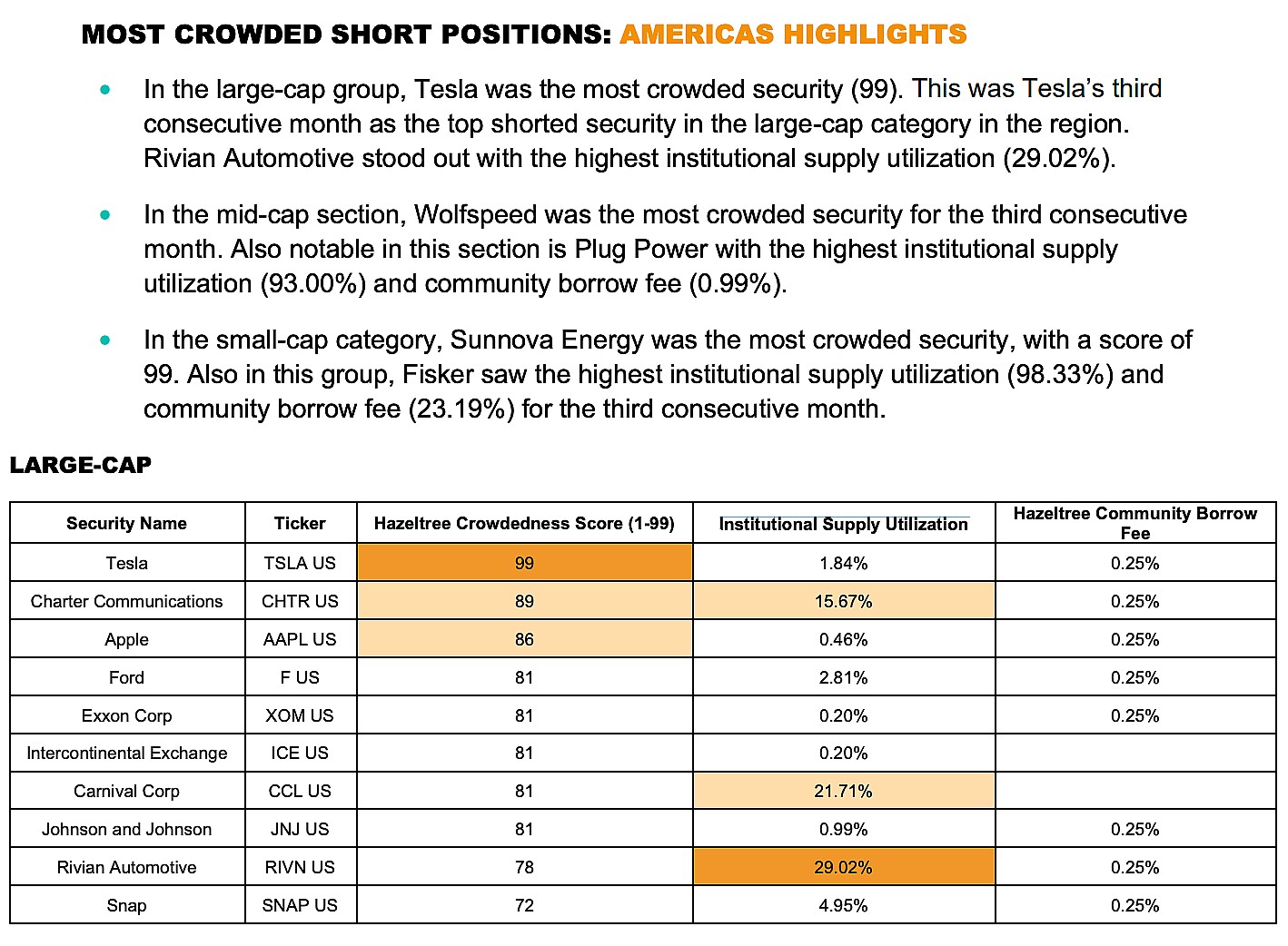

Tesla (NASDAQ: TSLA) was the most shorted stock in August in the Americas, and Rivian had the highest institutional supply utilization, according to new data from a cloud-based treasury and liquidity management solutions firm.

Tesla stock has had one of the more notable stands on Wall Street as a stock that has been bet against by investors and firms for years. However, after the company’s meteoric rally on the market over the past few years, it is evident that short sellers have taken quite a loss from their positions.

Nevertheless, the losses felt by the skeptics of the automaker’s stock have not convinced them to shy away from betting against the most successful electric car company on the planet.

New data from Hazeltree, cloud-based treasury and liquidity management solutions firm, shows that Tesla was the most crowded security for the third consecutive month in the “large-cap category” in the Americas region.

Hazeltree compiles its data by tracking approximately 12,000 global equities across the Americas, Europe, the Middle East, and Africa (EMEA) and the Asia-Pacific (APAC).

Rivian also had the highest Institutional Supply Utilization, meaning it is being shorted by institutions more than any other stock that was analyzed by Hazeltree.

Tesla is still the most-shorted stock, but its low institutional supply utilization, which stands at just 1.84 percent, means large firms are not shorting the stock as frequently as others. The short positions are coming from individual investors.

Over the past three months, Tesla’s institutional supply utilization has dropped, starting at 2.78 percent in June, 2.63 percent in July, and just 1.84 percent in August.

Rivian’s dropped slightly after appearing on the list for the first time in the firm’s July report, which saw their utilization rate at 33.21 percent.

Yesterday, Tesla stock surged 10 percent, helping the company gain billions in value after a note from Morgan Stanley talked optimistically about the Dojo Supercomputer.