- 💰 Tesla (NASDAQ:TSLA) has experienced significant pressure in 2024, evidenced by a 4.54% drop in its stock price on Wednesday.

- 📉 Year-to-date, Tesla has become the worst-performing stock in the S&P 500 index, with a decline of about 31%.

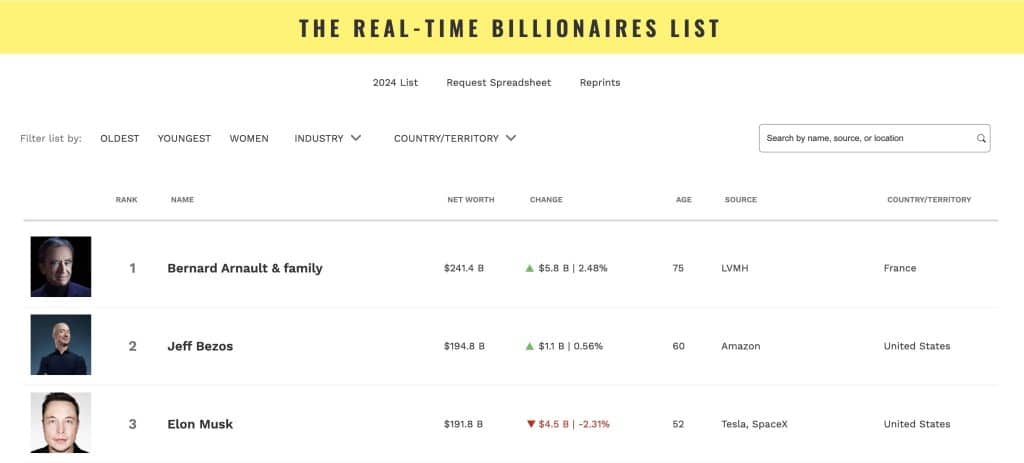

- 📊 This drop in Tesla’s stock value has led to CEO Elon Musk becoming the world’s third-richest person by net worth, with his wealth closely tied to Tesla’s stock performance.

- 📉 The decline in Tesla’s stock value resulted in a $4.5 billion reduction in Musk’s net worth, now estimated at $191.8 billion by Forbes.

- 📉 Musk’s net worth now ranks below that of Amazon founder Jeff Bezos, whose net worth is estimated at $194.8 billion by Forbes.

- 📈 However, despite the negative sentiments surrounding Tesla’s stock, Wedbush maintained an “Outperform” rating and optimistic $315 price target, expressing confidence in the company’s long-term prospects.

- 📈 Tesla’s long-term performance, despite recent setbacks, has been impressive, with its stock soaring by nearly 800% over the past five years.

- 🚀 Early investors in Tesla who held onto their shares since the company’s IPO in 2010 have seen even more significant returns, highlighting the potential for long-term growth in the company’s value.

In 2024, Tesla (NASDAQ:TSLA) has been making headlines not just for its groundbreaking electric vehicles but also for its performance in the stock market. The company, led by CEO Elon Musk, has experienced significant fluctuations in its stock price, sparking discussions among investors and analysts alike.

Understanding the Stock Decline

Since the beginning of the year, Tesla’s stock has faced substantial pressure, culminating in a 4.54% drop in its price on a single day. This decline is part of a larger trend, with Tesla emerging as the worst-performing stock in the S&P 500 index, registering a staggering 31% decline year-to-date. Such a downturn has inevitably raised concerns among investors about the future trajectory of the company’s stock.

Elon Musk’s Wealth and Influence

The performance of Tesla’s stock is closely intertwined with the fortunes of its CEO, Elon Musk. As Tesla’s stock experienced a downturn, Musk’s net worth also took a hit, dropping by $4.5 billion to $191.8 billion, according to Forbes estimates. This adjustment in Musk’s net worth has led him to slip from his position as the world’s second-richest person, ranking below Jeff Bezos, the founder of Amazon.

Analyst Perspectives and Investor Confidence

Amidst the negative sentiment surrounding Tesla’s stock, there are voices of optimism from analysts. Wedbush, for instance, has maintained an “Outperform” rating on Tesla, accompanied by an optimistic price target of $315. This vote of confidence from Wedbush indicates a belief in Tesla’s long-term potential, despite its short-term challenges.

Long-Term Performance and Investor Returns

Despite the recent setbacks in Tesla’s stock performance, it’s essential to analyze the company’s long-term trajectory. Over the past five years, Tesla’s stock has soared by nearly 800%, showcasing its remarkable growth and potential. Early investors who held onto their Tesla shares since the company’s IPO in 2010 have been handsomely rewarded, underscoring the value of long-term investment strategies.

Conclusion: Navigating Volatility

The fluctuations in Tesla’s stock price in 2024 highlight the inherent volatility of the stock market, especially in the tech and automotive sectors. While short-term fluctuations may cause concern, it’s crucial for investors to focus on the underlying fundamentals of the company and its potential for future growth. As with any investment, diversification and a long-term perspective are key to navigating market volatility and maximizing returns.