Key Points

- 🚗 Tesla reduced prices across its entire vehicle lineup, sparking a “price war” in the auto industry.

- ⬆️ New registration data indicates that Tesla’s price cuts have contributed to a 67% year-over-year increase in electric vehicle (EV) registrations, with Tesla maintaining a dominant 59.5% market share in the U.S.

- 📈 Model Y registrations more than doubled compared to the previous year, while the Model 3 also saw increased registrations.

- 💰 Tesla’s price cuts have made EVs more affordable, leading to an estimated 8.5% market share for EVs in July.

- 🌎 Tesla’s global sales by region or country are not disclosed, so the data is an estimate, and some automakers do not separate EV sales from gas cars.

Tesla has made price cuts across its entire lineup this year, effectively waging a “price war” against other automakers. According to new registration data in the U.S., the strategy seems to have boosted overall electric vehicle (EV) sales, with Tesla remaining the dominant market share leader.

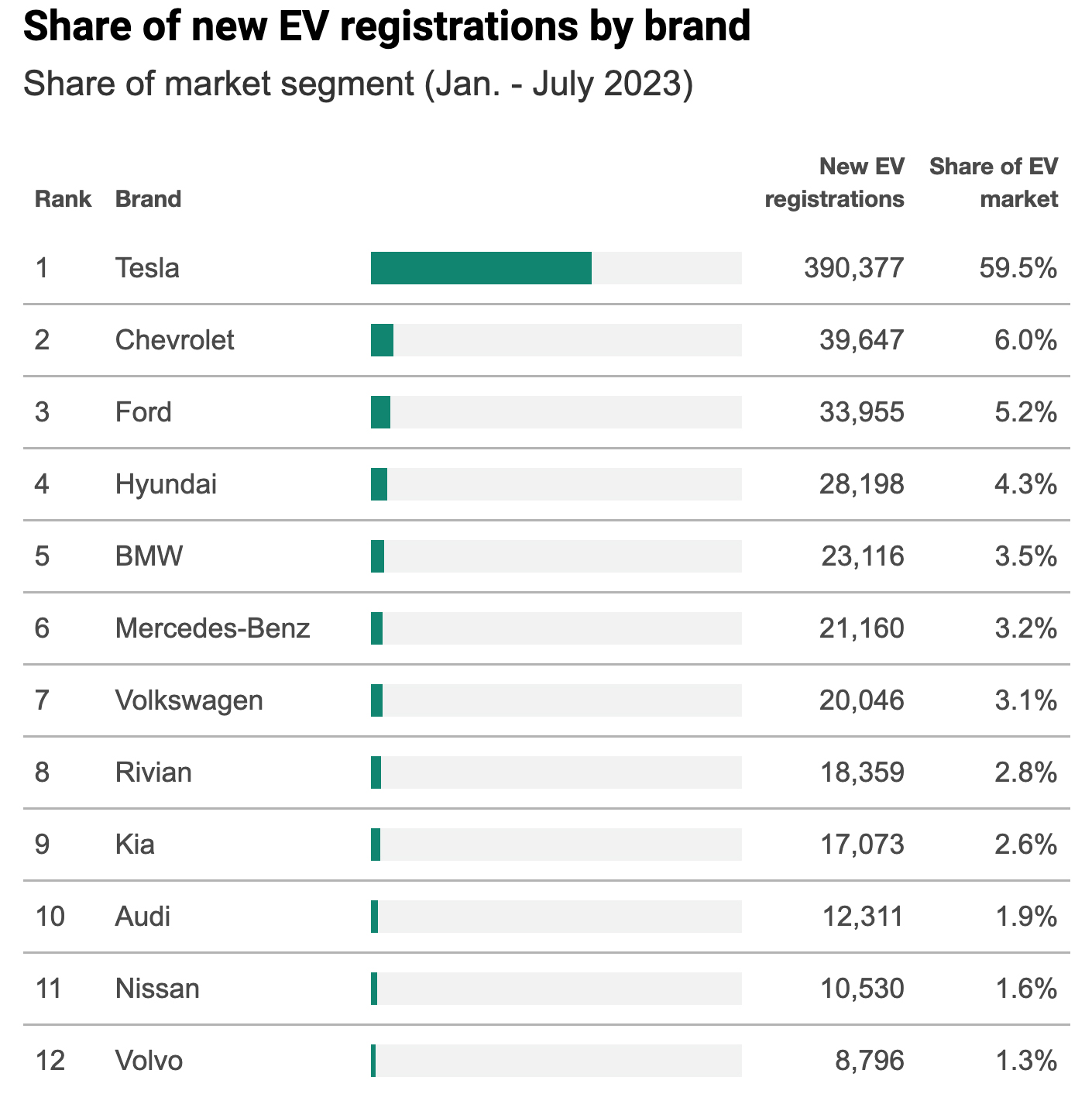

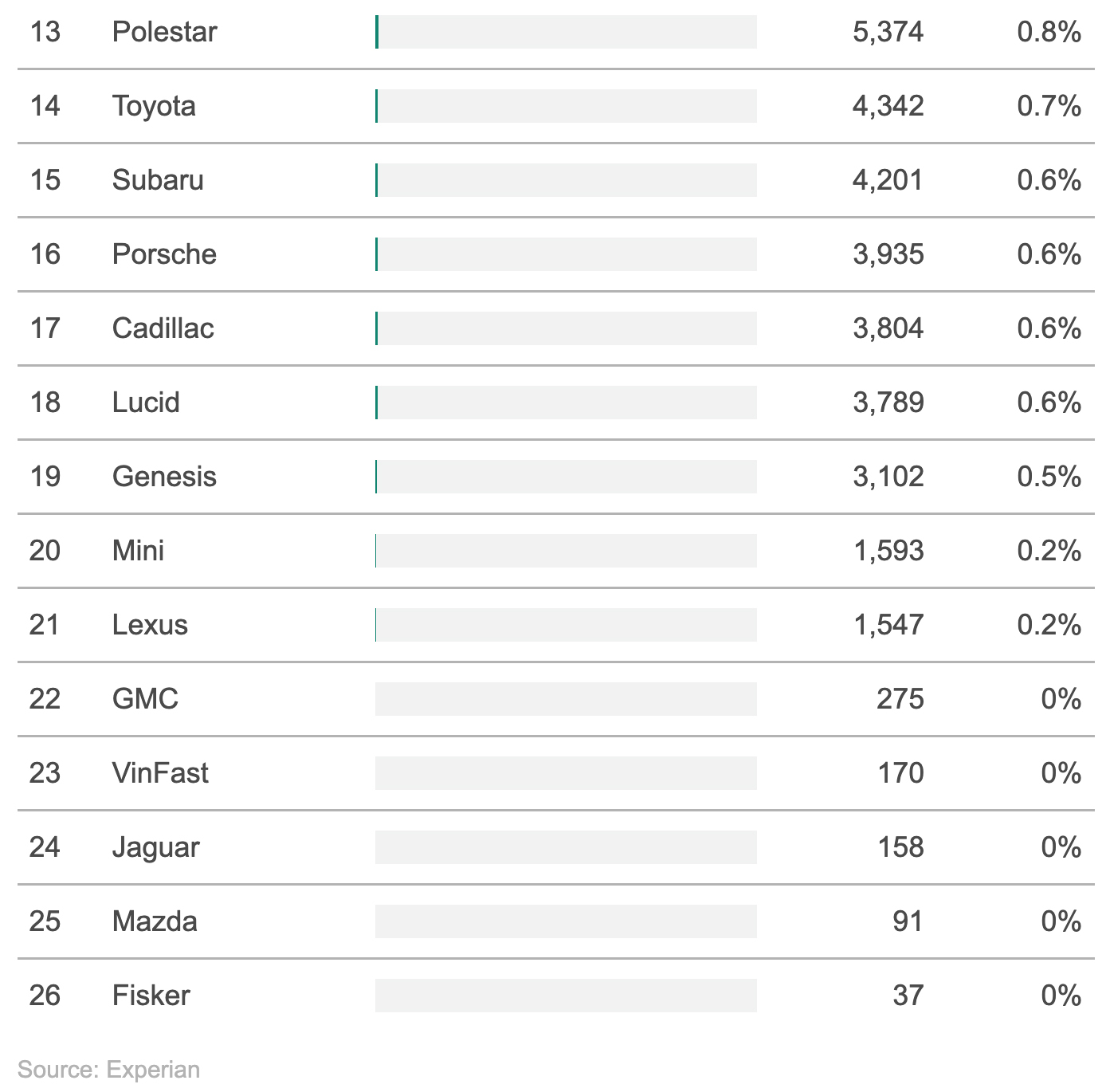

As shown in new registration data from Experian, the auto market share of EVs has risen to 7.2 percent this year in the period from January to July, with overall EV registrations jumping to 655,986 total for a 67 percent year-over-year increase (via Automotive News). During the same period, Tesla had 390,377 vehicles registered for a 50-percent jump from 2022, capturing a 59.5-percent share of the EV market.

Following Tesla’s registrations were offerings from Chevrolet (39,647), Ford (33,955), Hyundai (28,198) and BMW (23,116) to make up the rest of the top five registered EV brands in the U.S. Notable EVs sold by Chevy and Ford included the Chevy Bolt EV and Bolt EUV, the brand-new Silverado, the Ford Mustang Mach-E and the F-150 Lightning.

The data shows that Model Y registrations reached 236,041 in the seven months, more than double those of last year. Tesla had 131,381 registrations of the Model 3 in the period ending July, ahead of its launch of the forthcoming Highland Model 3. The Model S saw registration figures drop by 51 percent during the same period, landing at just 8,493, while the Model X fell 14 percent to 14,462 registered units.

Tesla cut prices on its vehicles in January, forcing some other automakers to follow suit. J.D. Power guessed that the overall EV market share had jumped to 8.5 percent in July, pointing to Tesla’s price cuts as a major catalyst in making EVs more affordable.

In one index, the organization also compares EVs to gas cars, rating them on a scale of 100 points. J.D. Power VP of EV practice Elizabeth Krear pointed out the price cuts from Tesla as a driver of increased market share in one analysis of the index last month.

“Affordability remains the highest-scoring factor at 97, driven by aggressive pricing from Tesla,” Krear said. “Although the affordability factor is approaching parity, it is skewed by the premium market, driven largely by Tesla’s 63 percent EV market share.”

It’s worth noting that Tesla doesn’t disclose global sales by region or country, so the Experian data is more of an estimate of sales than anything. In addition, many automakers do not report EV sales separately from their gas cars, and some don’t share their monthly sales.