Key Points

- 💡 Tesla has introduced a state electric vehicle incentive tool on its website to help customers calculate federal and state tax breaks for purchasing Tesla vehicles.

- 💡 The tool allows customers to understand the discounts they may receive for buying a sustainable vehicle, based on tax credits provided by both state and federal governments.

- 💡 Different locations may offer varying incentives, with some states providing additional credits on top of the federal tax credit, making the total tax break amount differ based on location.

- 💡 The federal EV incentives have been influenced by the Inflation Reduction Act, while local incentives aim to promote electric vehicle purchases on a state level, with some states striving for complete electric vehicle adoption by 2035.

- 💡 Tesla has updated the language on the design studio for the Model 3 and Model Y, clarifying that all new purchases of these models qualify for the $7,500 federal tax credit, and additional state incentives may be available.

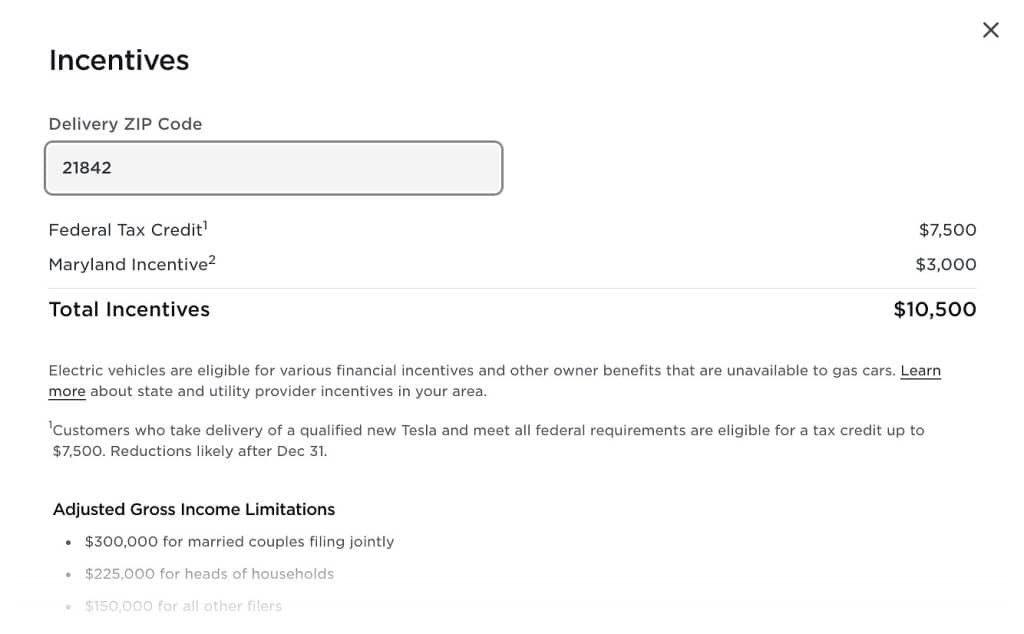

Tesla has introduced a new tool on its website that allows customers to calculate both federal and state incentives for purchasing one of their electric vehicles. The tool helps customers determine the total tax breaks they may receive, considering the incentives offered by both the state and federal governments for sustainable vehicle purchases.

In addition, Tesla has updated the warning on its website about the likelihood of revised federal incentives after the new year. This revision may affect the Model 3 and Model Y, potentially reducing the federal tax credit from the full $7,500 amount.

By using the state electric vehicle incentive tool, Tesla buyers can better understand the discounts they are eligible for based on their location and chosen vehicle model. For example, customers in State College, PA, would receive a $7,500 tax credit for purchasing a Model 3.

However, a potential buyer in Ocean City, Maryland, would receive both the $7,500 federal credit and $3,000 in Maryland state incentives.

There has been a lot of confusion regarding what vehicles will qualify for which credits, and whether customers would be able to receive the full $7,500 credit or a partial $3,750 credit based on things like where the battery materials were manufactured. These details incentivize the manufacturers to build the EVs and their parts here, while customers will be more inclined to buy American-built cars as they will qualify for the full credit.

The federal EV incentives have been driven by the Inflation Reduction Act. Meanwhile, local incentives help to drive consumers to purchase EVs on a state level, as several are aiming to push all new vehicle purchases to be electric by 2035. Maryland and California have adopted this strategy in an effort to achieve sustainability goals.

Tesla also updated the language on the design studio for the Model 3 and Model Y, taking away the direct mention of the December 31 incentive revisions that were posted earlier this month.

The alert now says:

“All new Model 3 and Model Y purchases qualify for a $7,500 federal tax credit for eligible buyers. Additional state incentives may be available.”

However, the language mentioning reductions are likely after December 31 is now included in the tool.