- 💼 The SEC has revised its climate rules draft, removing stricter emissions requirements.

- 📉 Companies listed in the NYSE are no longer required to disclose Scope 3 emissions.

- 🌍 Scope 3 emissions, including greenhouse gases, constitute a significant portion of a company’s carbon footprint.

- 🇪🇺 The SEC’s move diverges from EU rules, which mandate Scope 3 emissions disclosures.

- 📝 Many companies and trade groups have lobbied for softer emissions reporting rules.

- 🗣️ The SEC is considering updated rules based on public feedback.

- ❓ It’s uncertain if rules on disclosing Scope 1 and Scope 2 emissions are still part of the latest draft.

- 📋 Finalized draft will be presented to SEC commissioners for a vote, with no clear timeline provided.

- 🔄 The draft could undergo further revisions before the vote.

In a significant development, the U.S. Securities and Exchange Commission (SEC) has made amendments to its climate rules draft, marking a pivotal shift in regulatory requirements for corporations. Let’s delve into the implications of these changes and what they mean for businesses and environmental advocates alike.

Understanding the Changes

The SEC’s decision to revise its climate rules draft entails the removal of stricter emissions requirements, a move that has stirred discussions within both corporate and environmental circles. Here’s a breakdown of the key alterations:

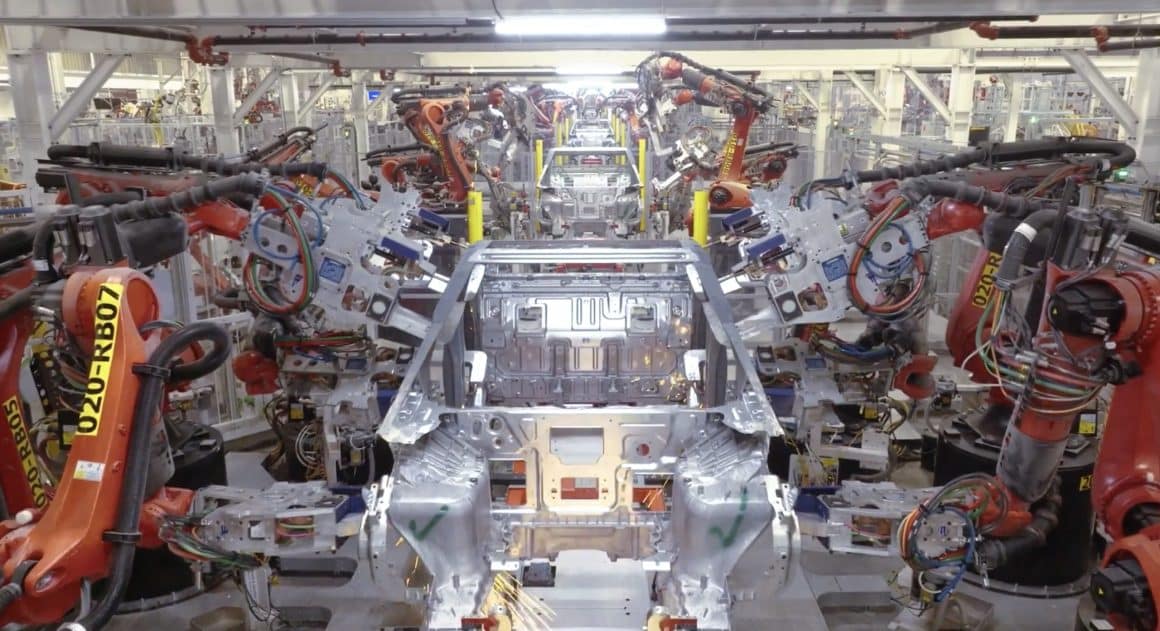

- Scope 3 Emissions Disclosure: Companies listed on the New York Stock Exchange (NYSE) are no longer mandated to disclose their Scope 3 emissions. Scope 3 emissions encompass a broad spectrum of greenhouse gases emitted throughout a company’s value chain, including those generated by suppliers and consumers.

- Divergence from EU Standards: The SEC’s departure from European Union (EU) regulations, which necessitate Scope 3 emissions disclosures, underscores a disparity in global approaches to climate accountability.

- Industry Lobbying: The decision reflects lobbying efforts from numerous companies and trade groups advocating for more lenient emissions reporting standards. These entities argue that compiling such data is onerous and raises legal complexities.

Implications and Considerations

The SEC’s revised climate rules draft prompts various considerations and debates:

- Corporate Accountability: The removal of Scope 3 emissions disclosure requirements raises questions about the extent of corporate accountability in addressing climate change. Critics argue that without comprehensive reporting, companies may obscure their environmental impact.

- Global Harmonization: The disparity between U.S. and EU regulations highlights the need for global harmonization of climate reporting standards. Inconsistencies across jurisdictions can lead to regulatory arbitrage and hinder efforts to combat climate change effectively.

- Transparency vs. Burden: Balancing the need for transparency with the burden of compliance is a recurring challenge in regulatory frameworks. While stringent reporting requirements enhance transparency, they may also impose significant administrative burdens on businesses.

Looking Ahead

As the SEC proceeds with the adoption of updated regulations, several uncertainties linger:

- Scope 1 and 2 Emissions: It remains unclear whether the latest draft retains requirements for disclosing Scope 1 and 2 emissions, which encompass direct emissions from sources owned or controlled by a company and indirect emissions from purchased electricity, respectively.

- Timeline for Implementation: The finalized draft is subject to approval by SEC commissioners, with no definitive timeline provided for the voting process. Additionally, the draft may undergo further revisions before reaching a consensus.

Conclusion

The SEC’s revision of its climate rules draft reflects a nuanced balancing act between environmental accountability and corporate interests. While the removal of stringent emissions requirements may alleviate regulatory burdens on businesses, it also raises concerns about transparency and environmental stewardship. Moving forward, stakeholders must engage in constructive dialogue to shape regulatory frameworks that foster sustainability while supporting economic growth.