CNN reported that Tesla’s stock surge isn’t just making Elon Musk and Tesla investors rich — it’s affecting other industries as well. Investors who are focusing on other industries, such as lithium and batteries, are also benefitting from Tesla’s success. This is something that many have foreseen since this summer just before Tesla’s Battery Day event last fall.

One of the funds the article mentioned is the Global X Lithium & Battery Tech ETF (LIT), which owns Tesla shares as well as other companies in the electric battery business. LIT is up 15% in 2021, and over the past three months, soared over 65%. I think it’s safe to say that anyone investing in battery and lithium stocks has been experiencing the “Tesla effect.”

Lithium

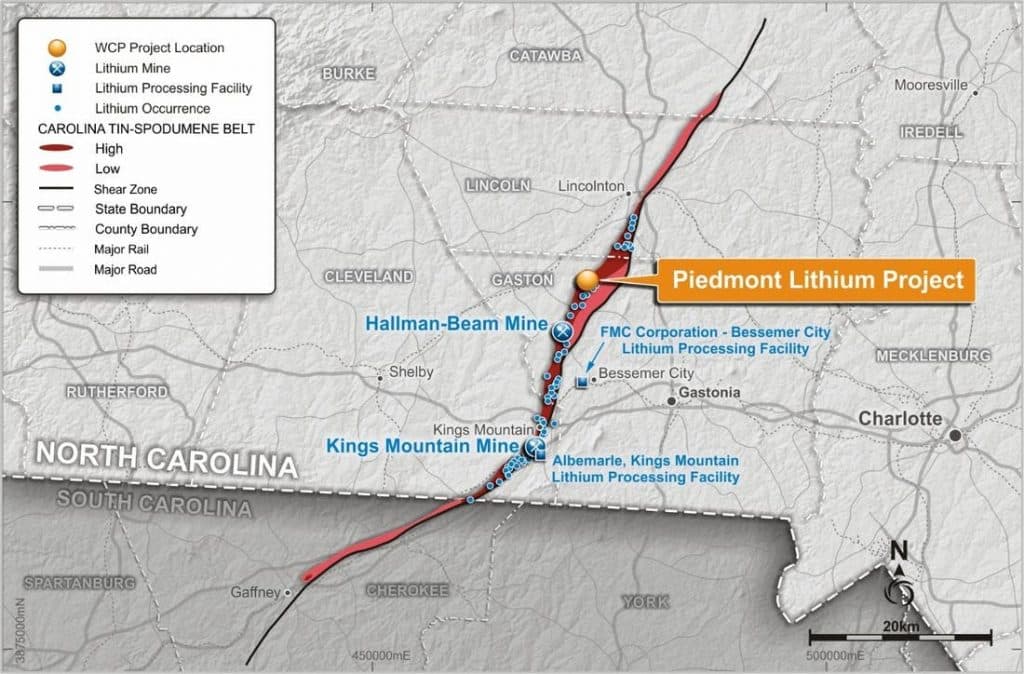

Keith Phillips, CEO of Piedmont Lithium (PLL) — which is a stock I own in my own tiny portfolio — shared his thoughts with CNN. “You can’t have electric cars without batteries and you cant have batteries without lithium.” Piedmont Lithium is a miner whose stock has surged almost 35% in 2021. EV batteries have other metals that can be swapped to various degrees, such as nickel, cobalt, and manganese, but Phillips told CNN that “you’re always going to need the same amount of lithium.”

Lithium, which has a high energy density and therefore is able to store more energy, is also the lightest metal “in the universe,” the article noted. This is key for any type of battery — especially an electric one. “Nothing can do what lithium does for portable charging,” Phillips explained.

Pedro Palandrani, a disruptive technology analyst at Global X, also had some thoughts about how growing global demand for EVs is helping mining companies, especially those that produce lithium as well as those that manufacture lithium-ion batteries. “There is still a huge opportunity for companies across the electric vehicle supply chain. Investors need to think more about that and not just about Tesla. Electric vehicle penetration could reach 50% of the auto market by 2030,” he said.

The article also noted that shares of Albemarle (ALB), which is an American specialty chemicals company that has lithium production facilities in Nevada, is the top stock in the lithium ETF. ALB has surged almost 25% this year and has doubled in the past three months. I just wrote an article on its plans to invest $20 million to $50 million to double lithium production at its Silver Peak site in Nevada by 2025.

The Tesla Effect

Lional Selwood, Jr., CEO of Romero Power, told CNN Business that the growing demand for EVs thanks to companies like Tesla is helping his firm because it is easier for his firm to produce lithium-ion batteries. “We’re building a business for commercial customers so we can get bigger contracts,” he said. “We’re piggybacking off of global consumer demand for electric vehicles since that brings prices down to make batteries.”

Palandarni also told CNN Business that Tesla deserves a lot of credit for its part in making the EV business go mainstream with both consumers and investors. His firm’s fund, Global X Autonomous & Electric Vehicles ETF (DRIV), counts Tesla as its top holding. He reminded investors that they shouldn’t ignore the other companies in the industry that are benefitting from the trend — companies such as BYD, CATL, and Ganfeng, which are all based in China, were noted. “We’re talking about the disruption of transportation,” Palandrani said. “It would be myopic to think that Tesla is the only important company in the industry.”

My Thoughts

As I wrote this, I took notes. I definitely plan on adding at least one share of each of these funds (except PLL since I have that already) to my own personal portfolio. I’m not only investing to make money, but I want my money to help disrupt transportation. Ever since I started with Tesla two years ago, I’ve felt this Tesla effect my own life.

Note, of course, that nothing here is investment advice and we do not provide investment advice at CleanTechnica.

Interestingly, in an article I wrote in June, I analyzed a video interview of RK Equity’s Howard Klein by the EV Stock Channel on YouTube. In that video, Klein predicted PLL’s success, success that we have now witnessed. That was when I bought my first share of PLL, which was trading back then at $12 or so per share. Tonight, it’s over $40 per share.

Klein noted that many shy away from investing in lithium since it’s been considered unconventional. However, Elon Musk’s reputation for being both unconventional and successful, he noted, could impact the lithium industry in a positive way. What inspired me to invest in lithium stocks was this quote by Klein:

“Tesla is the leader in so many things and everybody is trying to copy them to some degree. If VW or GM saw that Tesla got into lithium mining, all of a sudden there would be a rush.”

I like the idea that my extra money is being invested in disrupting transportation — for the obvious good it does. My small amounts may not be much, but I feel that it does help more than putting the money somewhere else, and that makes it easier to sleep at night — knowing that I’m playing a small role in making our world a bit better.

Original Publication by Johnna Crider at CleanTechnica.