Tesla’s (NASDAQ: TSLA) network of Superchargers enables Tesla drivers to recharge their cars in as little as an hour, reducing range anxiety and improving the experience of owning a Tesla. Below, we take a look at how Tesla’s supercharger network is expanding and compare its growth with the company’s cumulative deliveries and rival charging networks.

View our dashboard analysis on A Closer Look At Tesla’s Charging Infrastructure

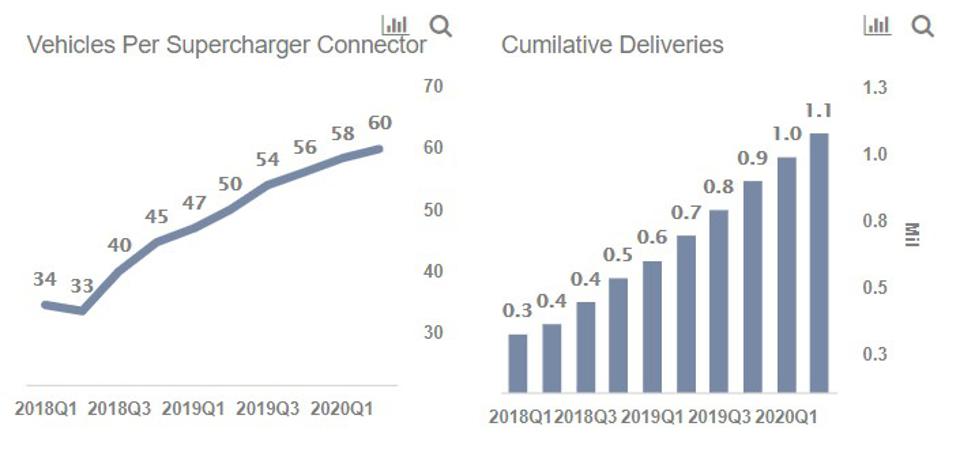

Tesla’s Supercharger Network Is Growing, But Not Quickly Enough

Tesla’s Supercharger network has grown from around 1,200 stations in Q1’18 to over 2035 stations as of Q2’20. The number of Supercharger connectors, which indicate the number of vehicles that can be charged simultaneously, has expanded from 9.3k to 18k over the same period. The number of Supercharger connectors per Supercharger location has expanded modestly from 7.7 to 8.9 over the period. However, with the launch of the Model 3 and Model Y, and Tesla’s rapid production scale-up, the number of Teslas on the road is outpacing the growth of its Supercharger network. As Tesla’s Cumulative deliveries have grown from 320k in Q1’19 to 1.1 million in Q2’20, this means that the number of Vehicles per Connector has grown from under 35 in early 2018 to about 60 presently. Tesla owners can still use third-party networks (which may require adapters) although the speed and experience are unlikely to be the same as using Tesla’s own supercharging.

How Does Tesla’s Network Of Chargers Compare With Rivals?

Tesla is still ahead of its rivals when it comes to fast charging – with a total of over 9,600 supercharger points in North America. In comparison, ChargePoint, an independent network of EV chargers, has about 2,020 DC fast charging points while Volkswagen’s Electrify America network has about 2,000 points. However, Tesla’s overall network, which includes fast chargers and slower Level 2 chargers stands at about 20k in North America. This is well behind ChargePoint which has close to 35k charging connectors.

Further Buildouts, Battery Improvements Could Help Tesla Address A Shortfall

However, there are a couple of ways Tesla could address a potential congestion issue. The first and most obvious solution would be to build out more Superchargers. Tesla now has adequate capital to do so, holding about $9 billion in cash as of the most recent quarter. In addition to this, Tesla will likely count on improving the range of its new cars to reduce their dependence on chargers. Tesla can do this via more compact and cost-efficient batteries or other drivetrain improvements. For example, during its battery day event, the company said that its new “tabless” batteries could enhance range by 16%. See our interactive analysis How Tesla’s Battery Costs Impact Its Gross Margins for a detailed look at the economics behind Tesla’s batteries.

What if you’re looking for a more balanced portfolio instead? Here’s a high-quality portfolio to beat the market, with over 100% return since 2016, versus 50% for the S&P 500. Comprised of companies with strong revenue growth, healthy profits, lots of cash, and low risk, it has outperformed the broader market year after year, consistently.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Original Publication by Trefis Team at Forbes.

Want to buy a Tesla Model 3, Model Y, Model S, or Model X? Feel free to use my referral code to get some free Supercharging miles with your purchase: http://ts.la/guanyu3423

You can also get a $100 discount on Tesla Solar with that code. Let’s help accelerate the advent of a sustainable future.