The market for electric vehicles is relatively new and rapidly developing. EV models are being introduced by unfamiliar companies seemingly every day. It’s all a little confusing. Investors need to orient themselves in the changing landscape so they can better compare models, makers and, more important, EV stocks.

The State of the Art

Investors don’t have that problem with gasoline powered cars. There is a century of history, so much goes without saying. Investors and consumers know what to expect regarding cost, mileage, reliability and power from, say, a Honda (ticker: HMC) Civic. It’s a four cylinder—and there is no need to add the word “engine.”

Nothing goes without saying in EV land. Lucid Motor, for instance, introduced the Lucid Air luxury sedan on Wednesday boasting about its battery efficiency, due in part to a “Lego brick” design. It isn’t obvious why Legos make for better batteries.

In addition, Nikola picked a battery platform called ultium, from General Motors (GM), to power some of its coming vehicles. Nikola shares soared 41% following the announcement. It was a surprising move for what amounted to one manufacturer signing a long-term supply agreement with another manufacturer.

About Battery Suppliers

Batteries, of course, are a big deal for electric vehicles. But GM doesn’t even make the batteries. For that matter, Tesla (TSLA) doesn’t make its batteries, either. It has a huge battery factory in Nevada, but it was built in partnership with Panasonic (6752.Japan).

Panasonic is one of four big battery producers, along with Contemporary Amperex Technology (300750.China), Samsung SDI (006400.Korea) and LG Chem (051910.Korea). GM sources its batteries from LG.

Today’s batteries are based on lithium-ion technology, but there are many types of lithium ion batteries that cost different amounts to manufacture. Down the road, there will be new technologies that displace today’s batteries.

QuantumScape, for instance, is planning to make better batteries and is becoming a publicly traded company through a merger with special purpose acquisition company Kensington Capital Acquisition (KCAC).

QuantumScape wants to be a supplier to the industry and it might have a breakthrough product. But it will have to compete for market share. EV makers can make bad bets on battery technology and the smart ones will keep their options open. But batteries alone shouldn’t decide which EV makers win or lose.

Battery Systems

Battery systems, however, are the first real point of differentiation for any EV maker.

The battery pack, the electric motors, the power inverter and the battery- management system are, essentially, the EV powertrain. It is analogous to the engine, differential, transmission, gas tank and exhaust system in a gasoline powered vehicle.

Car makers don’t make every single piece of traditional power trains. They won’t make all the components of an EV power train, either. Magna (MGA) and BorgWarner (BWA), for instance, supply components for both gas and EV power trains.

What Investors Need to Know

How to decide who makes the best EV power train isn’t a trivial matter. Ultimately, it will come down to profit margins. Investors should expect that all EVs—within typical car categories—will cost similar amounts and get similar range. Marketing and market share will dictate that. What will vary is EV maker profitability.

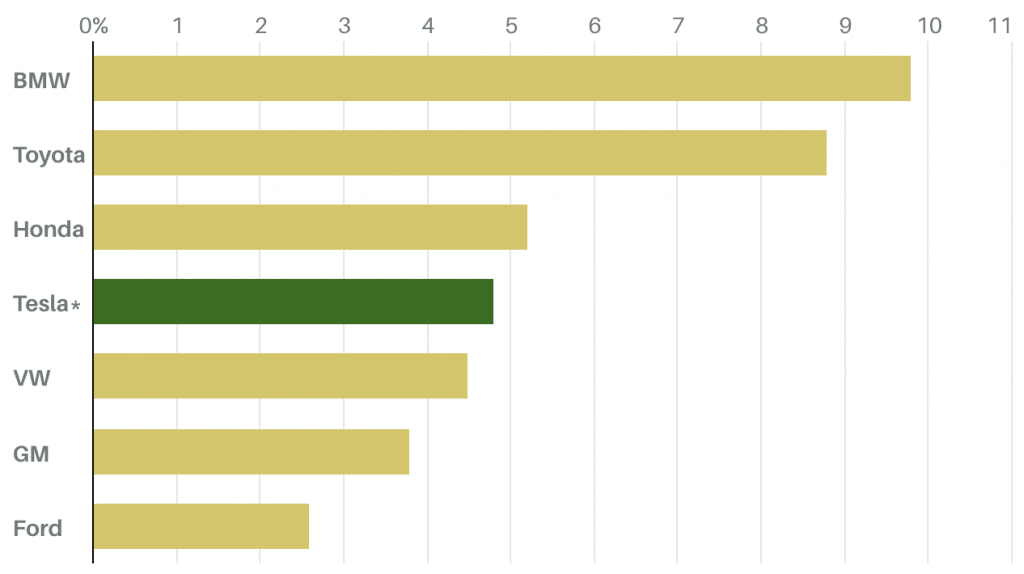

Within the traditional car business, Toyota (TM) and BMW (BMW.Germany) have industry-leading profit margins. With EVs, Tesla is profitable now. Not many other EV makers are.

Over time, with higher volumes, there will be EV winners and losers and it will show up in profit margins. Investors will have to watch profitability as volumes rise to decide who really is the best at engineering battery systems.

Average Operating Profit Margin From 2013 Through 2019

Sources: Bloomberg, Barron’s calculations

Profits, in many cases, are years away. Wall Street, for instance, doesn’t expect Chinese EV maker NIO (NIO) to turn a full-year profit until 2023. There are still some things to compare among EV makers that don’t require an electrical engineering degree.

Focusing on vehicle efficiency is a good place to start. Consider that the Lucid Air boasts more than 500 miles in range, besting the Tesla Model S and its 400 mile range.

The Lucid Air gets 500 miles from its 113 kilowatt-hour battery back. The vehicle is getting more than 4 miles per kilowatt-hour. The Tesla Model S gets about 4 miles per kilowatt-hour from its 100 kilowatt-hour battery pack. The Lucid looks a little more efficient than a Model S.

Both are luxury sedans, but a top end Air will retail for $169,000. The Model S starts at about $75,000. Consumers will pay for efficiency. What’s more, the Nissan (7201.Japan) Leaf retails for about $30,000. The Leaf looks to get about 226 miles of range from a 62 kilowatt-hour pack—less than 4 miles per kilowatt-hour.

The Leaf looks less efficient than the other two, but there are engineering choices made for cost and manufacturing reasons. What investors can do, however, is compare efficiency metrics within car categories. That will give a sense of who is leading the EV race.

EV Is Different

Buying an EV isn’t quite like buying a gasoline powered car. Investing in EV stocks isn’t like investing in traditional car companies, either. EV companies grow faster than traditional peers and get big valuation multiples.

But high valuation hasn’t scared investors away from EV stocks. Tesla shares, for instance, are up about 340% year to date, crushing comparable returns of the S&P 500 and Dow Jones Industrial Average.

To avoid getting burned from today’s heightened stock prices, investors will have to upgrade their EV investing game—just like EV makers try to upgrade their product offerings.

Original Publication by Al Root at Barrons.

Want to buy a Tesla Model 3, Model Y, Model S, or Model X? Feel free to use my referral code to get some free Supercharging miles with your purchase: http://ts.la/guanyu3423

You can also get a $100 discount on Tesla Solar with that code. Let’s help accelerate the advent of a sustainable future.