Key Points

- ⚡ In Q3, electric vehicle (EV) sales in the U.S. reached 300,000, setting a new record as consumer choices in the EV market expand.

- 📈 This represents a nearly 50% increase compared to the same quarter in the previous year, with overall EV adoption rising to 7.9% in Q3.

- 🚗 Tesla, a dominant leader in the EV market, saw its market share decrease from 62% to 50% in Q3, partly due to production constraints related to factory upgrades.

- 💲 Tesla initiated a “price war” by consistently reducing prices on its EV lineup throughout the year, putting pressure on other automakers to follow suit or risk losing potential buyers.

- 📉 As a result of increased competition and price reductions, average EV prices in the U.S. dropped from $52,212 in August to $50,683 in September.

- 💼 Lower prices, greater product availability, and an abundance of inventory have led to continued growth in EV sales in the U.S. market, with consumers benefiting from a wider range of choices.

Sales of electric vehicles (EVs) surpassed an important milestone in Q3, marking a record quarter as the options available to consumers continue to increase.

EV market sales in the U.S. reached 300,000 during the third quarter, according to data from Cox Automotive in a report from Reuters this week. The increase represents an almost 50-percent increase from last year’s Q3, while overall EV adoption rose to 7.9 percent in the same quarter.

Dominant EV leader Tesla fell short of Q3 analyst delivery estimates, as announced earlier this month, and the automaker’s market share dropped from 62 to 50 percent in Q3. During the Q2 earnings call earlier this year, the automaker also predicted a drop in production during the third quarter due to factory upgrades.

Tesla has also stirred what many have termed a “price war” by reducing prices across its lineup throughout much of the year.

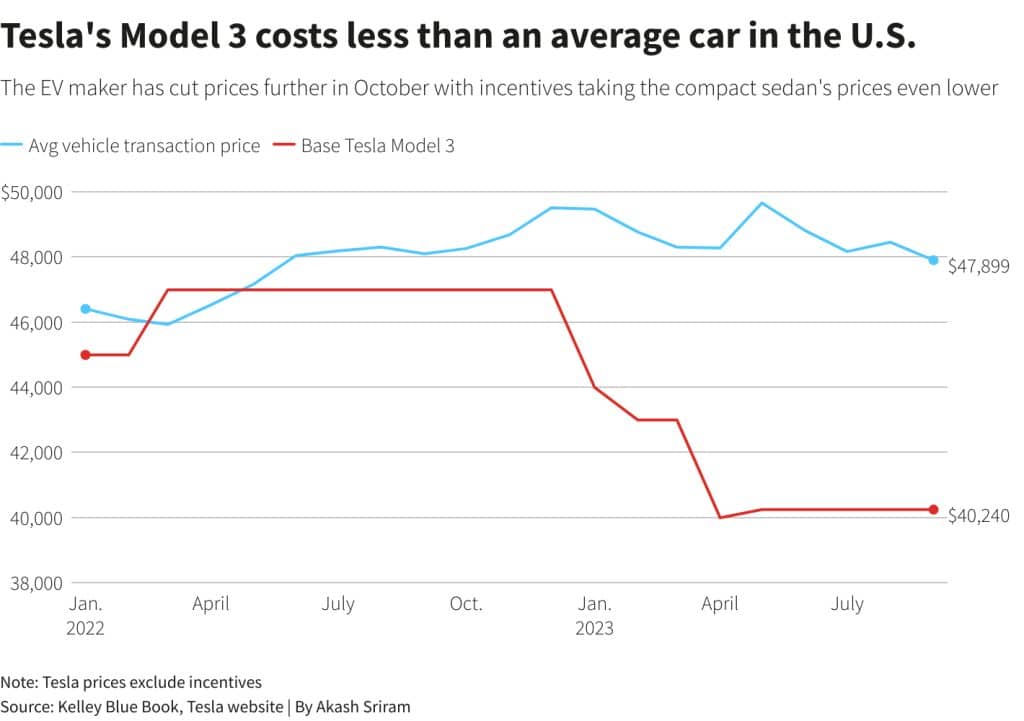

Most recently, Tesla cut the price of its Model 3 sedan and Model Y SUV just this week, which is the latest reduction after the automaker launched lineup-wide price cuts in January with more following in the months since. Tesla also began offering a more affordable Model Y configuration earlier this month.

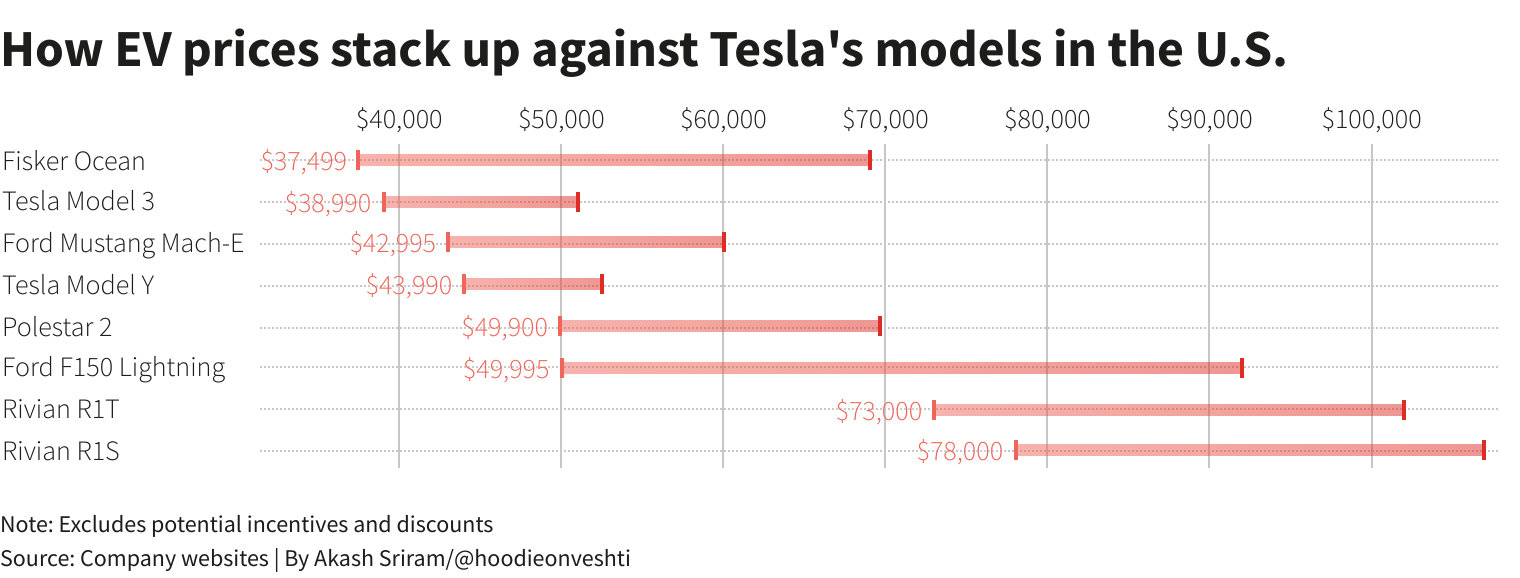

The result has put pressure on other automakers, as they have been forced to either cut prices on their EVs or miss out on buyers seeking the best deal. An increase in electric options and lower prices on EVs are expected to boost demand, and the Cox report showed that average EV prices dropped to $50,683 in September from $52,212 in August.

“Higher inventory levels, more product availability, and downward pricing pressure have helped spur continued linear growth of EV sales in the U.S. market,” Cox said in the Thursday report.

The news comes after the price cuts have brought the price of the Tesla Model 3 and the Model Y beneath the average car price in the U.S. this year. It also comes ahead of Tesla’s initial deliveries of the highly anticipated Cybertruck. Although the automaker’s market share decreased in Q3, the increase of overall EV deliveries is considered a positive for the automaker.

In the past, Tesla CEO Elon Musk has emphasized the company’s goal to accelerate the world’s transition to EVs, even embracing increased competition as a means to that end.

“So, for us, we’re very philosophically motivated. We care about the advancement of electric vehicles,” Musk said in an interview in 2015. “To that end, we also open sourced all of our patents. So, we said any car company can use our technology — it’s no problem. They don’t even have to pay a fee to us.”