- 🚀 Tesla’s stock surged over 20% after a strong earnings report highlighting impressive margins and future guidance.

- 📉 Cost of Goods Sold per Vehicle decreased to the lowest in Tesla’s history, improving margins significantly.

- 📈 Tesla’s gross margin and operating margin rose to 19.8% and 10.8%, respectively.

- 📅 Investors are optimistic about 2025, with projected delivery growth of 20% to 30%.

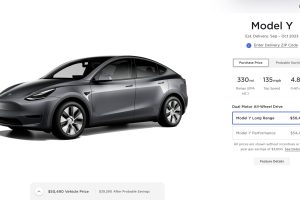

- 🚗 Tesla plans to introduce several affordable models in 2025, built on a next-gen platform.

- 🛻 The Cybertruck is contributing positively to Tesla’s profits less than a year into deliveries.

Tesla has once again captured the attention of investors and market analysts alike, surging more than 20% following the announcement of its strong earnings report. The company has demonstrated significant improvements in core financial metrics, promising future growth, and strategic advancements. In this blog post, we’ll dive into what has driven this exceptional performance and what investors and enthusiasts can expect from Tesla in the coming years.

Breaking Down Tesla’s Financial Success

Tesla’s recent earnings report has been a beacon of positivity for the electric vehicle giant. Here’s a closer look at the pivotal factors that contributed to this impressive financial stride:

Strong Margins: A Key Success Factor

One of the most discussed aspects of the earnings report is Tesla’s noteworthy margins. The company’s gross margin has risen to 19.8% while its operating margin has improved to 10.8%. These figures represent a significant improvement and signal a robust financial health that is attractive to investors.

- Gross Margin Enhancement: The increased gross margin indicates that Tesla is becoming more efficient in converting sales into actual profit.

- Operating Margin Improvement: A higher operating margin showcases Tesla’s ability to manage operating expenses effectively while boosting profitability.

Cost Efficiency: Lowest Cost of Goods Sold (COGS)

Tesla has achieved a milestone by reducing its Cost of Goods Sold per Vehicle to the lowest in its history, marking a substantial step in driving efficiency and cost-effectiveness in its production processes:

- The COGS now stands at approximately $35,100 per vehicle, enabling Tesla to expand its profit margin.

- This reduction is attributed to technological advancements, refined production techniques, and perhaps strategic supply chain management.

Looking Ahead: 2025 and Beyond

Investors have significant reasons to be optimistic about Tesla’s future, particularly with the exciting projections and plans for the year 2025.

Projected Growth and New Models

CEO Elon Musk has projected a substantial growth rate in deliveries, estimating an increase of 20% to 30% for the year 2025. Several strategic initiatives support this optimistic outlook:

- Next-Gen Platform Vehicles: Tesla plans to introduce several affordable models in the first half of 2025. These upcoming vehicles are anticipated to cater to a broader audience due to their affordability and will be built upon an innovative next-gen platform.

- Focus on Affordable Models: Expanding its product lineup with more cost-effective options will likely position Tesla better within the competitive market landscape, attracting a new segment of customers.

The Cybertruck Effect

Another bright spot in Tesla’s financial report is the positive impact of the Cybertruck, which has been a revenue driver since its inception. Here’s how:

- Revenue Contribution: Despite being less than a year into its deliveries, the Cybertruck has already contributed positively to Tesla’s bottom line, showcasing strong demand and acceptance among consumers.

- Leading Innovation: As one of the unique offerings from Tesla, the Cybertruck represents Tesla’s edge in vehicle design and market innovation.

Navigating Future Challenges and Opportunities

While Tesla’s current trajectory is promising, the path ahead isn’t devoid of challenges. The automotive industry is rapidly evolving, and Tesla will need to continue innovating and adapting to maintain its market position.