Key Takeaways

- Tesla shares have dropped significantly since the start of the year, causing frustration among investors.

- Shareholders are using Elon Musk’s tactics against him, requesting him to justify his leadership by listing five achievements for Tesla shareholders.

- The request references a controversial email by Musk demanding federal employees justify their paychecks, a tactic he previously used at Twitter.

- Celebrity photographer Jerry Avenaim actively questioned Musk’s contributions via social media, highlighting dissatisfaction among investors.

- Tesla did not provide a comment in response to inquiries about shareholder concerns.

Amidst the volatility of the stock market, one company that has recently caught the attention, frustration, and concern of many investors is Tesla. With its shares dropping significantly since the start of the year, questions have been raised about its leadership and future. At the helm of these discussions is none other than CEO Elon Musk, who has found himself in an unusual position of being held accountable by his shareholders.

Tesla Shareholders Demand Accountability

The ongoing decline in Tesla’s stock has created a sense of alarm and dissatisfaction among its investors. Faced with a loss of value, Tesla shareholders are now putting pressure on Elon Musk, the maverick leader whose unorthodox management style has previously charmed Wall Street. Now, however, the tables have turned.

Shareholders are asking Musk to justify his leadership by outlining five significant achievements he has accomplished for the shareholders. This demand is not just about listing accomplishments; it reflects a deeper quest for reassurance and direction as Tesla navigates tumultuous market waters.

The Root of the Controversy: Musk’s DOGE Email

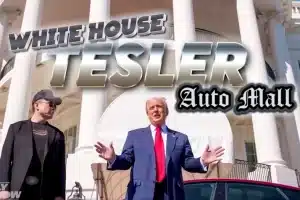

The demand for accountability surfaced as investors drew parallels to a controversial approach Musk previously employed. This tactic involves demanding that federal employees justify their pay by listing accomplishments, which Musk used in his time at Twitter and later aimed at government workers through a DOGE-themed email directive.

This move did not sit well with civil servants, evoking widespread criticism. The parallelism with Tesla investors’ demands suggests that shareholders are now using Musk’s own strategies to hold him liable for Tesla’s performance.

Vocal Criticism and Social Media Interrogation

Celebrity photographer Jerry Avenaim, along with numerous other investors, has been vocal about querying Musk’s contributions through social platforms like X (formerly known as Twitter). Such public inquiries underscore an undercurrent of doubt and dissatisfaction. When high-profile figures begin questioning leadership openly, it signifies broader discontent and concern over what the lack of transparent achievements could mean for the company’s and its investors’ future.

Silence Speaks Volumes

Despite the mounting pressure and public outcry, Tesla has maintained silence. The absence of a response is often as telling as the presence of one, conveying either a strategic choice of refusing engagement or an inability to address concerns conclusively. This silence leaves investors and analysts to speculate on the company’s trajectory and its leadership’s strategic planning.

Analyzing the Impact: Investor Sentiment and Tesla’s Market Future

- Stock Performance and Sentiment: The decline in Tesla’s share value has directly hit investor confidence. As studies often show, investor sentiment can drive further stock volatility, creating a self-fulfilling cycle of decline unless reassurances or a performance turnaround is observed.

- Leadership Image: The spotlight on Musk’s controversial managerial styles and the demand for evidence of his accomplishments can affect public perception. A leader’s image in the market is crucial, especially in tech sectors where visionary leadership significantly influences stock performance.

- Market Strategy Reevaluation: Investors now call for a reevaluation of Tesla’s strategies, seeking transparency and clearer guidance. A focused communication strategy from Tesla may help mitigate fears and restore some degree of investor trust.

As Tesla continues to experience stock value challenges, its leadership under Elon Musk is under scrutiny like never before. The situation presents an opportunity for Musk and the Tesla management team to engage investors with transparency and steadfast commitment. Moving forward, the focus should be on accountability, strategy reassessment, and open communication to navigate the high-stakes environment of the global stock market effectively.