Just recently, Tesla received what could very well be one of its most bullish takes from Wall Street to date, with Canaccord Genuity analyst Jed Dorsheimer acknowledging the potential of the company’s battery business, among other things. During a segment at CNBC’s The Squawk, Dorsheimer noted that Tesla’s primary edge lies in the fact that it simply tackles problems in a way that is fundamentally different from the norm.

And this, according to the analyst, is a crucial advantage—one that could help the EV maker keep its lead in the electric car sector. “Tesla is bringing a machine gun to a knife fight,” Dorsheimer noted.

In a lot of ways, Dorsheimer’s statements ring true. CEO Elon Musk has noted that Tesla should be seen as a chain of about a dozen startups that are each working towards a specific goal. As Musk said, many of the “startups” under Tesla’s umbrella actually have little to no correlation with traditional automotive companies. These include the company’s energy business, which the CEO predicts would comprise a large portion of Tesla in the future.

Despite this, few have looked at Tesla with such a lens. A look at the coverage of Tesla in the mainstream media over the years would show that numerous traditional auto analysts have been wrong about the stock, and even big bulls like Cathie Wood of ARK Invest do not typically cover Tesla’s potential in segments such as battery storage and residential solar. And this, at least for many of Tesla’s critics, has proven to be a costly misstep, as evidenced by TSLA shorts’ $38 billion loss last year.

A group that may very well have acknowledged Tesla’s bigger picture could be retail investors, many of whom are not investing experts. Instead, they are category experts, mastering the unique niche that Tesla was carving for itself. Partly thanks to the emergence of such a group, Tesla’s mid-2019 to 2020 stock performance represented one of the largest transfers of wealth from Wall Street to Main Street investors to date.

What is rather remarkable is that Tesla’s potential is hiding in plain sight. Its electric car business may not produce vehicles at the same volume as Toyota for now, but its numbers are growing massively every year. It only has a couple of functioning car factories today, but both are pushing out vehicles with frightening efficiency. Tesla’s battery storage and solar business may be easy to overlook as well, but its potential is vast as it exists in a sector that’s ripe for disruption.

Inasmuch as all the pieces of the Tesla puzzle are visible, however, it is very easy for someone with a narrow-minded lens—perhaps one focused on month-over-month vehicle deliveries in specific territories—to miss the forest for the trees. And in a way, this is partly due to Tesla’s strategy itself, which tends to keep things understated, despite Elon Musk’s Twitter habits.

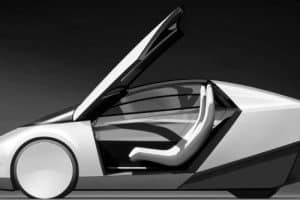

From its vehicles to its battery storage systems, Tesla’s entire lineup is designed with simplicity in mind. This was something that Top Gear presenter Chris Harris mentioned back in 2019 when he went behind the wheel of the Model 3 Performance. Harris sharply criticized the Model 3 for its unassuming look, but he was blown away by its performance, which included the vehicle walking all over the best of ICE on the track. Summing up his thoughts, Harris noted that the Model 3 was an “AK-47 disguised as a butter knife.”

This still pretty much applies to Tesla’s current lineup of products. From the Semi to Full Self-Driving to Autobidder, most of Tesla’s creations are designed to usher in a paradigm shift in their respective segments. They just typically come in packages that are easily judged and just as easily miscalculated. Fortunately, and considering the growing community of people well-versed in Tesla’s efforts, the company’s efforts will likely not remain unacknowledged. After all, if Canaccord Genuity analyst Jed Dorsheimer’s recent statements are any indication, it appears that even Wall Street is starting to appreciate the forest a little bit more.