Elon Musk recently announced that Tesla is planning to open its Supercharger Network to other EVs later this year. Following the announcement, Goldman Sachs crunched the numbers and estimated that Tesla could make more than $25 billion in annual revenue by opening up its charging network to other electric cars.

As part of its computation, Goldman Sachs considered the amount of Level 3 Superchargers in Tesla’s networks. According to the investment bank’s research, Tesla has ~3,000 stations with about 25,000 or more stalls. It also considered the amount Level 2 Destination Chargers Tesla built in partnership with various hotels, restaurants, shopping centers, and resorts.

Tesla has Superchargers in various parts of the globe, which would be beneficial to any EV owner. As such, Goldman Sachs concluded that Tesla has the “largest fast-charging network in the world.”

“Tesla opening up its network could represent a sizable opportunity over time as the EV fleet grows, especially if Tesla charges more for non-Tesla owners…” wrote the investment bank in its research.

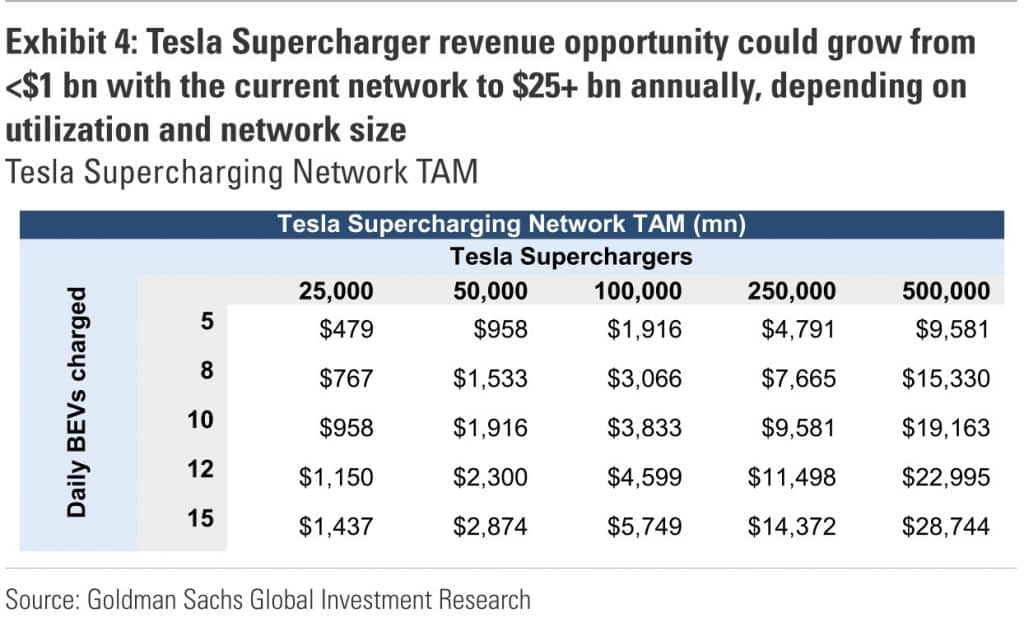

“In Exhibit 4, we show the potential revenue opportunity if Tesla were to open up its Supercharger network to non-Tesla vehicles and charges on a per-use basis. The first column shows the monetization opportunity with Tesla’s current installed base of 25k chargers, and if the base grew to 500K Superchargers in the long-term for illustrative purposes (could be a 25+ bn in annual revenue, depending on average use and price.”

Tesla’s Supercharger Network is poised to be a leader in the EV charging business, thanks to its headstart in the electric vehicle industry. The Supercharger Network is leaps ahead of other EV charging infrastructure because it grew as Tesla expanded its reach around the globe.

Even so, Tesla would need to make adjustments to the Supercharger Network to accommodate other EVs. Opening the network to non-Tesla cars would likely bring about as many opportunities as it does challenges.