Tesla’s market share in the United States is still strong but it is being challenged by less expensive options as consumers are opting for affordable electric vehicles.

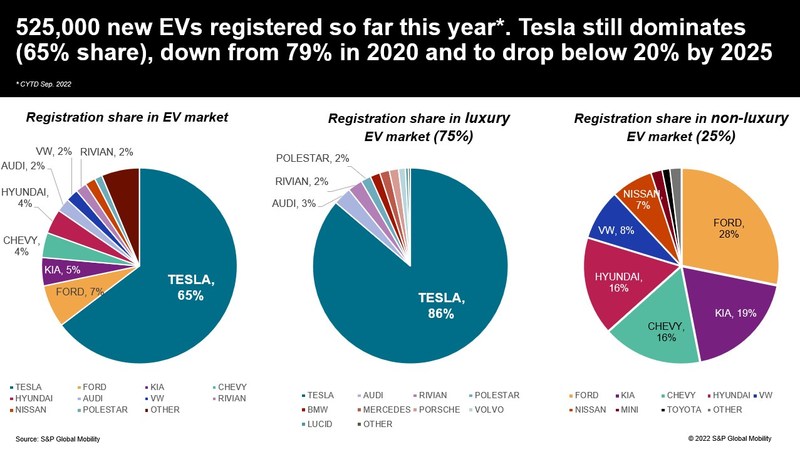

A new study from S&P Global Mobility shows Tesla still holds a considerable amount, 65 percent, to be exact, of the U.S. electric vehicle market. However, this figure is down from 79 percent two years ago, and pricing is the biggest reason.

“Much of Tesla’s share loss is to EVs available in a more accessible MSRP range – below $50,000, where Tesla does not yet truly compete,” the firm said in its report.

340,000 of the roughly 525,000 EVs registered from January to September 2022 were Teslas. 56 percent of the market was controlled by the Model 3 and Model Y. The remaining sales are divided amongst 46 other EVs that are “competing for scraps” until electrification is more widespread amongst U.S. consumers.

Tesla has four of the top five EV models by registration from January to September. The vehicles in the sixth through tenth positions are the Chevrolet Bolt EV/EUV (21,600 registrations), Hyundai Ioniq5 (between 17,000-18,000 units), Kia EV6 (between 17,000-18,000 units), Volkswagen ID.4 (11,000 units), and Nissan Leaf (10,000 units).

Tesla still obviously dominates the field. However, S&P Global Mobility notes Tesla’s position is changing because more affordable options are available, and they offer “equal or better technology and production build.” Because of this, the firm’s report notes that Tesla’s ability to retain a dominant market share will not be guaranteed in the future.

The group of 48 competing models to the Model 3 and Model Y will only grow. The firm forecasts 159 models across all manufacturers in the U.S. EV market by the end of 2025, which is faster than Tesla will be able to add production volume through new manufacturing plants. Tesla does plan to eventually attack the affordable market with the rumored $25,000 model, which CEO Elon Musk confirmed during the Q3 earnings call was in development. When Tesla will launch the vehicle is unclear, but its competition in the affordable vehicle market will be thick when the car is eventually brought to production.

Tesla is one of the few automakers that is a pure-EV company. S&P Global Mobility’s report estimates this could be the company’s biggest advantage as “few EV owners have returned to ICE powertrains.” However, Tesla brand loyalty could be tested as more EVs enter the market. The Model Y currently has 60.5 percent brand loyalty, and nearly 74 percent of buyers were first-time Tesla owners. These figures both lead the industry.