Tesla is still a relatively young carmaker, but it is already competing in the market against veteran and mainstream automakers. But even among the world’s biggest car manufacturers, Tesla appears to have a very particular strength — it’s not only great at retaining its customers; it’s also excellent at stealing and keeping buyers from other carmakers.

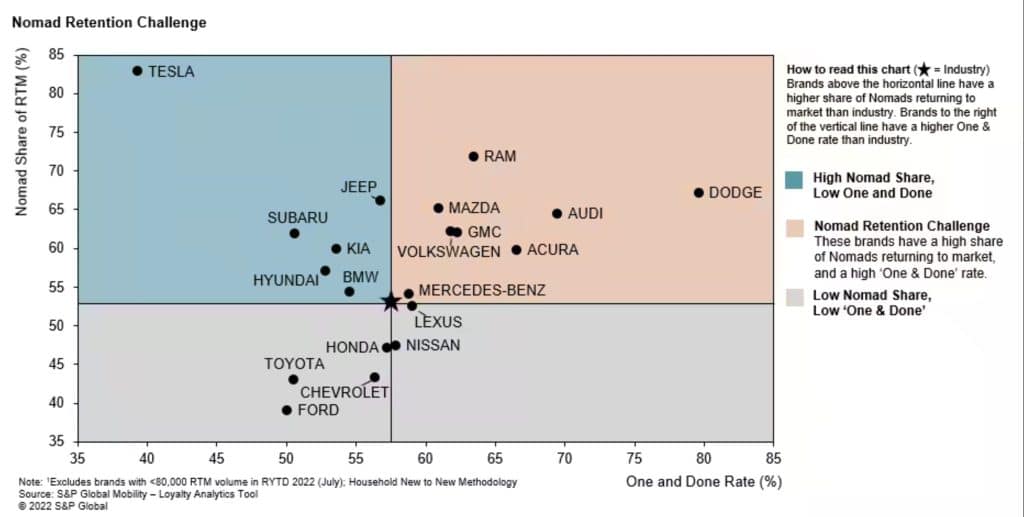

As per S&P Global, car buyers can be classified into three groups based on their loyalty: Super Loyalists, Loyalists, and Nomads. Super Loyalists have a history of repeatedly purchasing from the same car brand and are the most likely to continue doing so. Loyalists have made repeat purchases over their buying history, and Nomads have no recognizable loyalty to any brand and are more likely to switch.

American-based data from S&P Global has revealed that Tesla stands far ahead of other carmakers when it comes to retaining its customers. As per the firm’s data, over 80% of Tesla owners are Nomads that are new to the company. This is not surprising at all since the carmaker is a new player in the industry. It does, however, hint that a lot of car buyers are looking to electric cars as alternatives for their combustion-powered vehicles.

But what truly sets Tesla apart from the competition is its “One and Done” rate, which refers to the number of buyers owning a brand of vehicle and leaving it. In the 12 months ending July 2022, about 58% of Nomad car buyers in the United States left their vehicle brand, the highest “One and Done” rate in the last ten years. Tesla’s “One and Done” rate, however, stands at just 39%, which means that about 60% of the company’s customers will probably replace their existing electric car with another Tesla.

“While Tesla’s high share of first-time owners (83%) isn’t too surprising, their ability to keep those new customers is extraordinary. Tesla’s ‘One and Done’ rate is just 39% compared to 58% for the industry (remember, a lower number is better in this case). The next-best ‘One and Done’ rate goes to Ford at 50%. However, Nomad share of Ford’s return-to-market households in less than half of Tesla’s,” S&P Global wrote.

Erin Gomez, associate director of consulting for S&P Global Mobility, issued a statement on the firm’s findings. “Aside from the massive, long-term undertaking of creating products in new segments, there are other ways automakers can increase loyalty from their current Nomads. By understanding the loyalty makeup of their customer base, and where their Nomads are going, brands can take a more targeted and efficient marketing approach to retain them,” Gomez said.

The S&P’s analysis can be accessed here.