The Rivian R1T is now the electric truck with the most range after receiving a 328-mile range estimate from the Environmental Protection Agency (EPA).

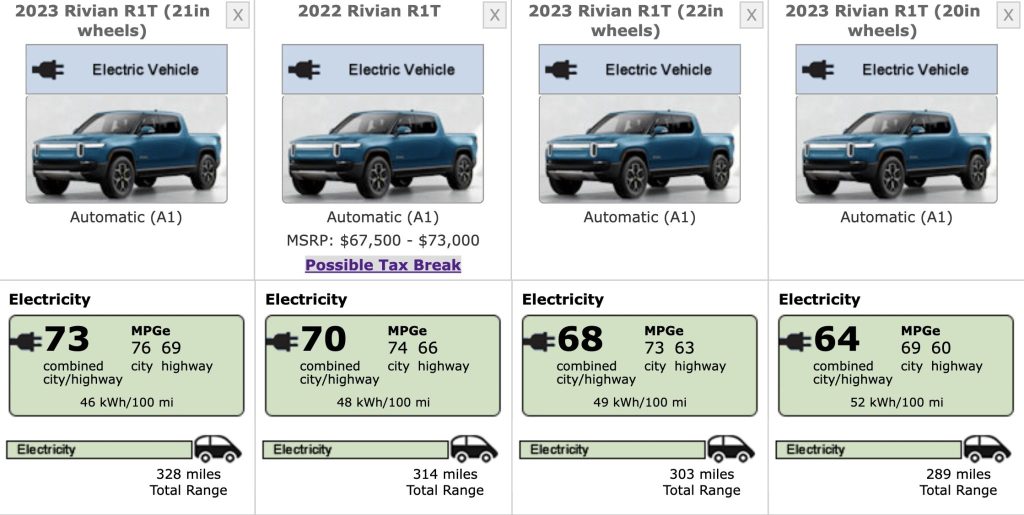

The 2023 Rivian R1T with 21-inch wheels received an EPA range estimate of 328 for the Quad-Motor with a Large battery pack configuration. 2023 Rivian R1T owners who ordered the Quad-motor with a Large battery pack configuration can save up to $3,500 in fuel costs over the next 5 years.

For comparison, the 2023 R1T with 22-inch wheels has an EPA estimated range of 303 miles, with calculated fuel savings of $3,000 over 5 years. While the 2022 Rivian R1T with 20-inch wheels saves owners up to $2,750 in fuel costs in 5 years with an EPA estimated range of 289 miles.

Recently, Rivian sent letters to reservation holders who ordered Quad-Motor R1Ts with the Max battery pack. The company advised reservation holders to switch to Quad-Motor R1Ts with Large battery packs if they want to accept delivery in early 2023.

Rivian informed R1T reservation holders that the Quad-Motor R1T with Max battery pack would not be available beginning in 2023. The Max battery pack will only be available with Dual-Motor R1T orders next year.

Rivian offers three battery options for R1T orders: Standard, Large, and Max packs. The Standard pack has an estimated range of 260+ miles, while the Max pack has a range of up to 400 miles. In the middle is Rivian’s Large pack, which has an EPA estimate of 328 miles. The Max pack costs an additional $16,000 in the U.S. and $21,750 in Canada, while the Large pack costs $6,000 in the United States and $8,250 in Canada.

RIVIAN R1T TAX BREAKS

According to the EPA, the 2022 Rivian R1T—with an MSRP between $63,500 and $73,000—may qualify for tax breaks. The Inflation Reduction Act of 2022 introduced a federal tax credit of up to $7,500 on electric vehicles that meet specific government guidelines.

The EPA offered some advice to R1T reservation holders that might help them get tax breaks on 2022 R1T orders.

“If you entered into a written binding contract to purchase a new qualifying electric vehicle before August 16, 2022, but do not take possession of the vehicle until on or after August 16, 2022 (for example, because the vehicle has not been delivered), you may claim the EV credit based on the rules that were in effect before August 16, 2022,” noted the agency.

“If you purchased a qualifying electric vehicle on or before August 16, 2022, and placed it in service before January 1, 2023, you may claim the EV credit based on the rules that were in effect before August 16, 2022,” it advised.