- 📉 Tesla’s Q1 2024 deliveries declined by 8.5% year-over-year.

- 🔧 Production of over 433,000 vehicles with approximately 387,000 deliveries in Q1 2024.

- 📊 Tesla’s Q1 2024 production and delivery numbers fell below Wall Street’s estimates.

- 🏭 Reasons for production decline include Model 3’s updated production ramp and factory shutdowns at Giga Berlin due to shipping diversions and an arson attack.

- 📉 Year-over-year decline in deliveries is the first since the Covid pandemic in Q2 2020.

- 💼 Wall Street analysts may reduce volume and earnings per share estimates for 2024 due to Q1 results.

- 📉 Tesla stock dropped 6.10% in Tuesday’s premarket following the release of Q1 2024 production and delivery report.

In the world of electric vehicles, Tesla stands as a beacon of innovation, continuously pushing boundaries and reshaping the automotive industry. However, even giants stumble, and the recent revelation of Tesla’s Q1 2024 performance has stirred conversations across markets and among enthusiasts. Let’s delve into the numbers, dissect the factors at play, and explore the potential ramifications of this decline.

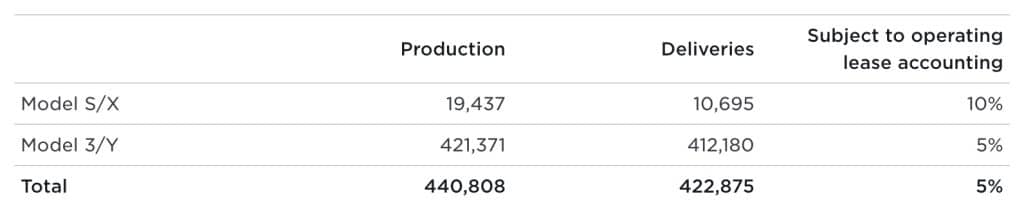

Understanding the Numbers

The figures paint a clear picture: Tesla’s Q1 2024 deliveries experienced an 8.5% year-over-year decline. Production numbers, though impressive at over 433,000 vehicles, couldn’t compensate for the shortfall in deliveries, standing at approximately 387,000 units. These results fell short of Wall Street’s expectations, signaling potential challenges ahead.

Unpacking the Reasons

Behind every statistic lies a narrative. In Tesla’s case, the decline can be attributed to several factors. The updated production ramp of the Model 3, a cornerstone of Tesla’s lineup, faced early-stage hurdles at the Fremont Factory. Furthermore, unforeseen disruptions, such as factory shutdowns at Giga Berlin due to shipping diversions stemming from geopolitical tensions and an unfortunate arson attack, added to the production woes.

Contextualizing the Decline

The 8.5% year-over-year decline in deliveries marks a significant shift for Tesla, representing its first downturn since the onset of the Covid pandemic in Q2 2020. Such a deviation from the norm raises eyebrows and prompts deeper analysis into the company’s operational dynamics and market positioning.

Implications for Investors

For investors, particularly those on Wall Street, Tesla’s Q1 2024 performance sparks concerns and prompts recalibrations. Analysts may revisit their volume and earnings per share estimates for the full-year 2024, factoring in the unexpected dip in deliveries. The 6.10% premarket drop in Tesla’s stock following the release of the Q1 report underscores the market’s reaction to these revelations.

Looking Ahead

What does this mean for Tesla’s trajectory? While a single quarter’s performance doesn’t define a company’s future, it serves as a barometer for its resilience and adaptability. Tesla’s ability to navigate challenges, streamline production processes, and maintain consumer trust will be pivotal in shaping its journey ahead.

Conclusion

Tesla’s Q1 2024 performance highlights the inherent volatility and unpredictability of the automotive industry, even for industry titans. As enthusiasts and analysts digest these numbers, one thing remains certain: Tesla’s story is far from over. The company’s response to adversity and its commitment to innovation will ultimately determine its fate in the ever-evolving landscape of electric mobility.