- 🚗 GEICO confirmed that it still provides insurance coverage for Tesla Cybertruck nationwide.

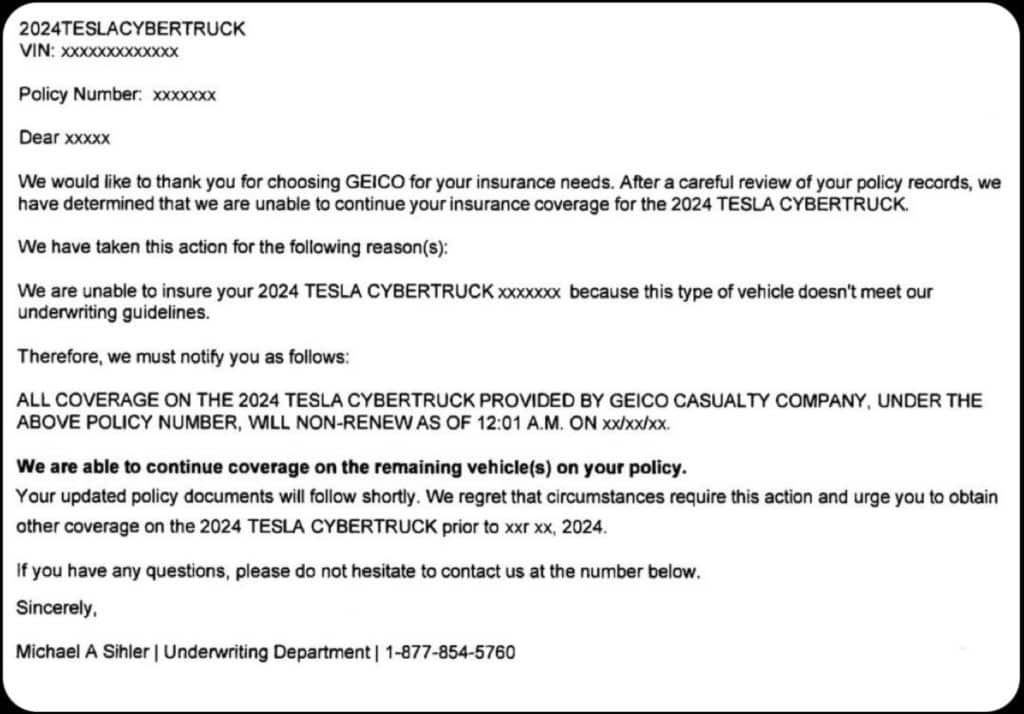

- 📜 A social media letter falsely claimed GEICO would stop covering Cybertruck due to underwriting guidelines.

- 📞 GEICO assured it will contact customers who received any incorrect nonrenewal notices.

- 🛠️ There are concerns about parts availability and the Cybertruck’s gross weight affecting insurance policies.

- 🔍 GEICO offers both personal passenger automobile insurance and commercial insurance for Cybertruck.

In recent times, the world of automotive insurance was shaken by a social media post claiming that GEICO would cease insuring the cutting-edge Tesla Cybertruck. This revelation stirred concern among Cybertruck owners who depended on the trusted provider for their insurance needs. Thankfully, these fears have been put to rest, as GEICO officially announced their continued support and coverage for this avant-garde vehicle.

Understanding the Initial Claims

The scare began with a letter circulated on social media, asserting that GEICO would terminate insurance coverage for the Tesla Cybertruck. This misleading letter attributed the drastic decision to underwriting guidelines, leaving many to question their future insurance options for their innovative vehicles.

Official Clarification from GEICO

In response to the sudden uproar, GEICO took swift action by reassuring its customers and the general public that the claims were unfounded. GEICO confirmed that they not only offer insurance for Cybertruck nationwide, but they also provide a dual approach: personal passenger automobile insurance and commercial insurance tailored for this modern marvel.

Direct Communication with Clients

To rectify the situation, GEICO pledged to reach out to any clients who received erroneous nonrenewal notices. Understanding the importance of clear and accurate communication in such sensitive matters, GEICO aims to restore confidence among its policyholders by resolving these misunderstandings directly.

Challenges Facing Cybertruck Insurance: Weight and Parts Availability

While GEICO remains committed to insuring the Tesla Cybertruck, there are inherent complexities to consider. The Cybertruck’s substantial gross weight and potential issues with parts availability during repairs pose unique challenges that could influence insurance policies. These factors highlight the importance of specialized coverage catering to the specific needs of this innovative vehicle.

Weight Considerations

The Cybertruck’s unique design and construction result in a higher gross weight than average vehicles in its class. This weight presents challenges in terms of repairs and replacements, potentially influencing insurance premiums and policies.

Parts Availability

Given the novel technology and build of the Cybertruck, parts may not always be readily available, possibly affecting the efficiency and cost of repairs. This scenario underscores the necessity for insurance providers like GEICO to prepare for these contingencies, ensuring seamless support for their policyholders.

Conclusion: A Trustworthy Partner in Cybertruck Coverage

In sum, GEICO’s commitment to continuing their insurance offerings for Tesla’s Cybertruck comes as a relief to current and prospective owners. The incident serves as a reminder of the importance of verifying information, particularly in the digital age, where misinformation can spread rapidly. Tesla Cybertruck owners can feel assured knowing that GEICO is maintaining comprehensive coverage and addressing concerns head-on.