Key Points

- 🚗 Mercedes-Benz’s EV sales in the U.S. increased by 284% in the third quarter of 2023.

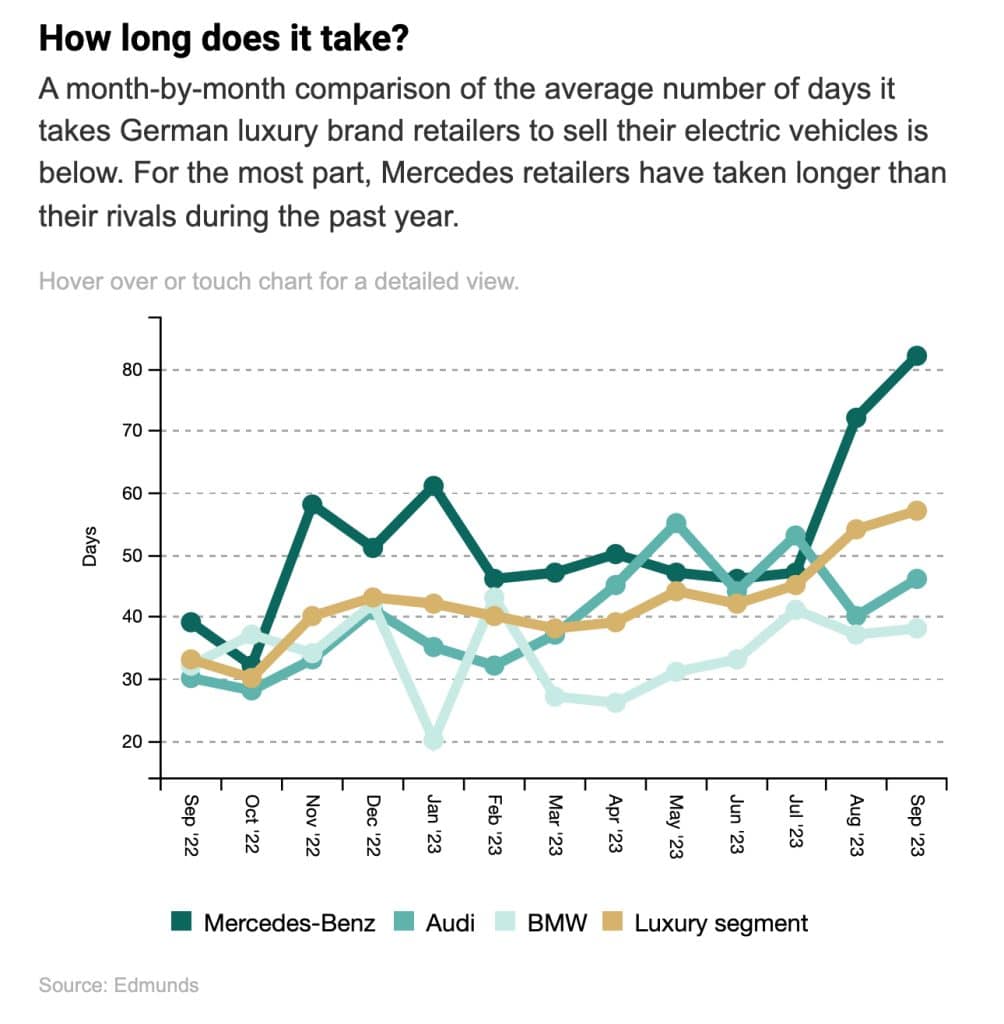

- 📊 Despite the sales increase, Mercedes-Benz’s EVs are taking longer to sell compared to other vehicles in the luxury segment.

- 🛍️ The average time for Mercedes-Benz EQ models to sell at dealerships in September was 82 days, while the luxury segment averaged 57 days, and BMW vehicles took around 38 days.

- 💰 Some Mercedes dealers attribute the slower sales to a lack of sales programs and the high price premium of the EQ models, especially in the top-end lineup.

- 🔌 Mercedes-Benz CEO Dimitris Psillakis cites challenges in product variety and supply chain issues as reasons for slow sales.

- 🌍 Mercedes delayed its internal electrification goals and is working to increase the supply of affordable EQB models.

- 📈 The average time to sell an EV increased significantly in 2023, with luxury EVs facing a greater increase.

Mercedes-Benz has seen the sale of its electric vehicles (EVs) increase significantly in the U.S. this year. However, a new report shows that dealers have had difficulty keeping up with inventory levels for the automaker’s EQ lineup, with sales times for the EVs exceeding the luxury segment average.

In the third quarter, Mercedes sold 10,423 EVs in the U.S., marking a 284-percent increase year over year. Despite the gradual increase in EV sales, the German automaker’s EVs are sitting on dealership lots and are not being sold off as quickly as other vehicles.

According to a report from Automotive News citing Edmunds data, Mercedes-Benz battery-electric EQ models took an average of 82 days to sell at dealerships in September. Comparatively, vehicles across the overall luxury segment averaged 57 days, while BMW vehicles took around 38 days to sell.

In various anonymous interviews with Automotive News, Mercedes dealers pointed to the brand’s lack of effort in responding to growing EV competition with sales programs and to the products themselves as the reasons for heightened inventory levels. One person who runs a Mercedes store said he currently has over six months’ worth of EVs and only a 50-day supply of the company’s gas cars.

“The EVs are coming whether or not you asked for them or earned them,” the retail store operator said. “There is too much of a price premium — especially at the top end of the EQ lineup — and almost no [lease] support.”

He added that the EQ models didn’t have the same “lust factor” as some of the automaker’s classic gas cars, including the S-Class sedan and the AMG-GT coupe.

“Our cars need to be ‘want’ cars,” he said. “The S-Class has maintained good loyalty because it’s aspirational. An EQS is not something that most people aspire to own.”

A Mercedes spokesperson declined to comment on internal discussions with its retailers.

CEO of Mercedes-Benz U.S., Dimitris Psillakis, blamed slow sales on a lack of product variety and on the EV segment being so new. Additionally, he pointed to issues in the supply chain as preventing variety at dealerships and keeping some more affordable models, such as the EQB compact EV, off of their lots.

“We are with a new lineup in a new world,” Psillakis said. “There is no past, there is no experience. We still face challenges around our product lines and have some restrictions coming from suppliers. We don’t always get the volume we want when we want it.”

Psillakis also said that Mercedes didn’t have any supply of the affordable EQB at the beginning of the year. Although this has changed, he says that it still takes time for the EV to reach dealers.

The Mercedes-Benz EV lineup and pricing structure is as follows, according to the automaker’s website:

- EQB (SUV); starts at $52,750

- EQE (sedan); starts at $74,900

- EQE (SUV); starts at $77,900

- EQS (sedan); starts at $104,400

- EQS (SUV); starts at $104,400

Other automakers have also faced difficulty in moving EVs alongside inflation and rising interest rates, and especially in the luxury segment.

The average EV overall sold in 36 days near the beginning of this year, according to a Cloud Theory report cited by Automotive News. By September, the report showed that this number had jumped to 80 days.

The problem is even worse for Mercedes and in the luxury segment overall. The average luxury EV sales time across brands increased by 73 percent in September compared to the same month last year, according to the aforementioned Edmunds data. For Mercedes dealers, the rate increased by 110 percent year over year.

“The ship of early adopters — willing to put a reservation down on virtually any EV announced — has sailed,” says Edmunds Insights Director Ivan Drury.

The report comes after Mercedes delayed its internal goals for electrification earlier this year, now aiming to reach a milestone of half of its auto sales being plug-in hybrids or fully electric by 2026 instead of a year prior. It also comes after Mercedes joined other automakers in adopting Tesla’s charging hardware, dubbed the North American Charging Standard (NACS).