Key Points

- 🚗 European EV market faces a potential slowdown as buyers anticipate more affordable models.

- 🔍 Concerns arise regarding high interest rates deterring consumers and impeding EV growth.

- 💰 EVs in Britain are approximately 33% more expensive than their fossil fuel counterparts.

- 🌍 Tesla’s announcement of a €25,000/$25,000 EV in the near future prompts potential buyers to wait for more cost-effective options.

- 📉 Volkswagen’s EV orders halved compared to the previous year, signaling a significant drop in demand.

- 📈 Despite sales warnings, Tesla aims to maintain its high delivery goals for the upcoming quarter.

- 🛣️ Buyers exhibit hesitancy due to concerns about technology advancement and future-proof options in the EV market.

- 🌱 Environmental consciousness conflicts with worries about charging infrastructure, battery life, and high prices for EVs.

- ⏳ Slowdown in EV sales anticipated until the release of more affordable EV models.

- 🏆 Tesla’s Model Y emerges as the top-selling vehicle in Europe, with Tesla reaching a milestone of one million vehicle deliveries across the continent.

- 💡 Auto companies like Ford and GM delay affordable EV launches due to perceived low demand and profitability concerns.

- 📊 Market analysis reveals consistent interest in buying EVs in Germany, but concerns about low residual values affect customer sentiment.

Several parties are echoing concerns about the European electric vehicle (EV) market as some buyers await new, more affordable models that are just a few years out — and as significant economic uncertainty remains.

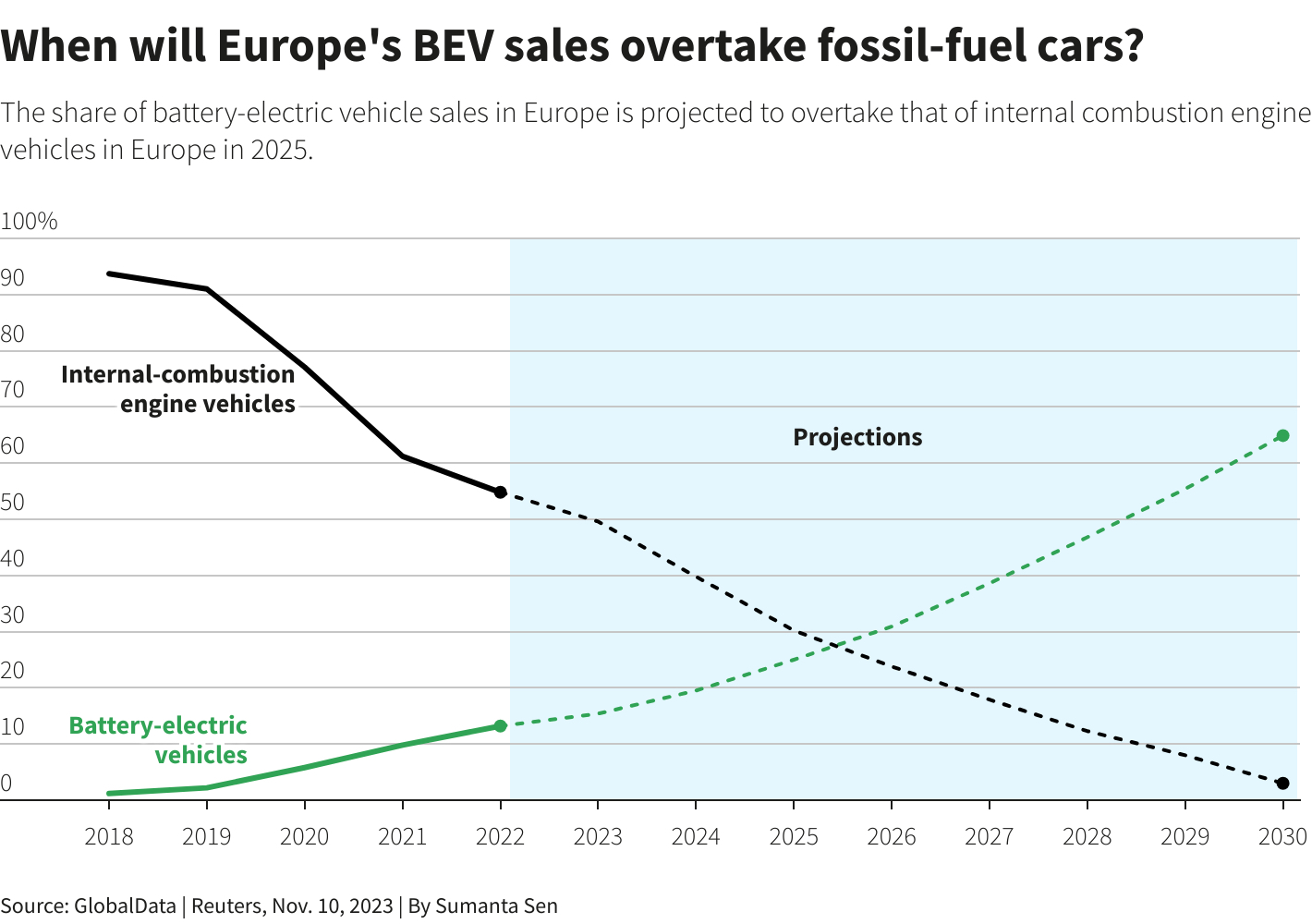

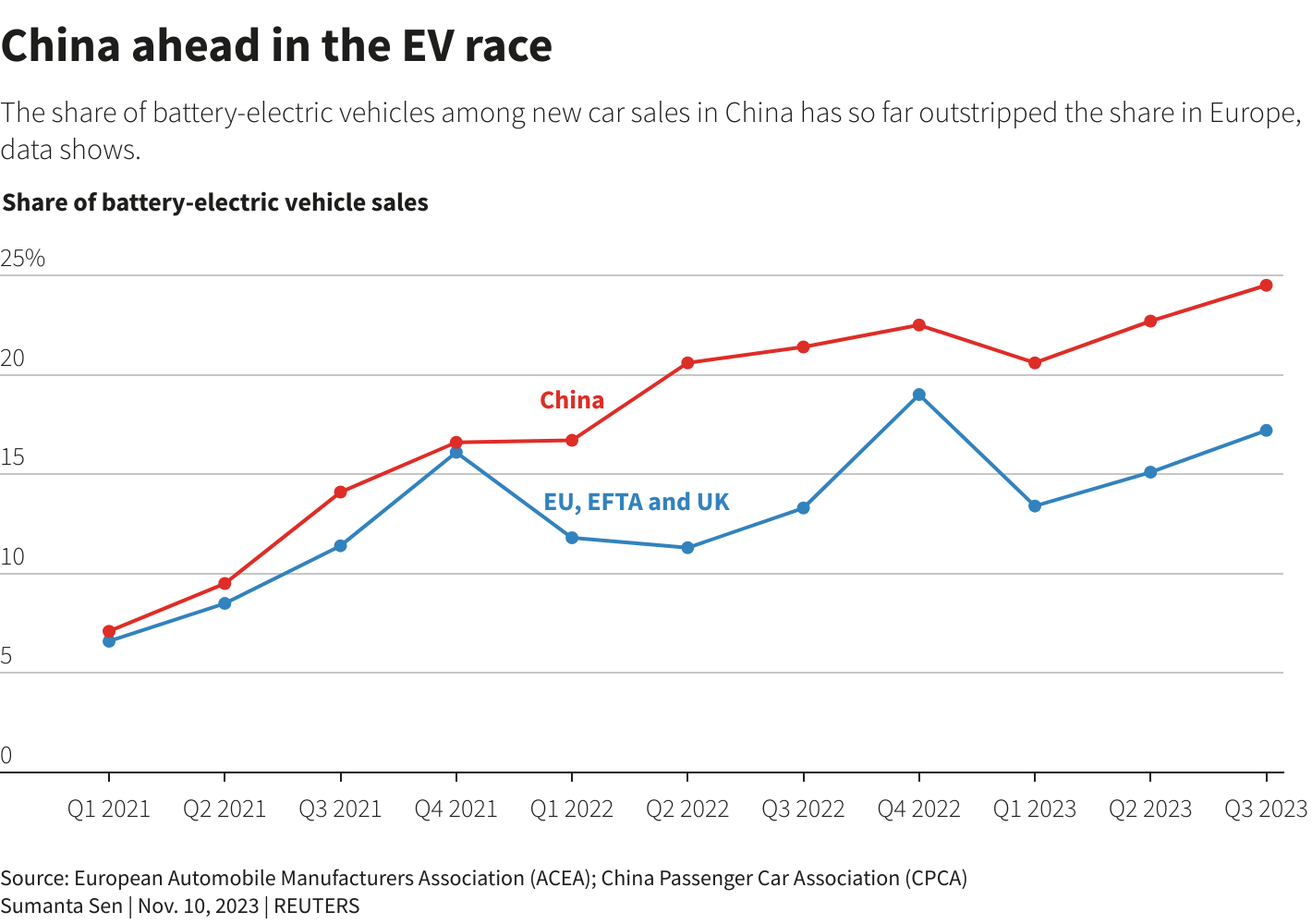

Sales of battery-electric vehicles (BEVs) jumped 47 percent in Europe throughout the first nine months of this year, according to Reuters. However, automakers including Mercedes-Benz, Volkswagen and Tesla have aired concerns about high interest rates putting off consumers and slowing EV growth.

According to AutoTrader, EVs in Britain are still roughly 33 percent more costly than their fossil fuel alternatives. Last week, Tesla announced plans to produce its next model, a €25,000/$25,000 EV, at its Gigafactory outside of Berlin, Germany. With the long-anticipated “affordable EV” on its way, some customers may be inclined to wait to buy, along with holding out for what they expect to be better products.

Volkswagen’s EV orders, as one example, were just half of what they were in 2022 during the same nine-month period. On Thursday, Volkswagen announced hopes to build a sub-$35,000 EV in the U.S. within the next three to four years.

Like many automakers, Tesla reported a slight delivery miss in Q3 compared to analyst expectations. However, the company had warned about sales slowing during the third quarter in its Q2 earnings call, and the company has still maintained its lofty delivery goal for Q4, which seems like a good sign.

Even beyond the economic environment and hopes for an affordable EV, data analysis firms and dealerships warn that buyers are holding off until they feel convinced that the technology meets their needs. Thomas Niedermayer, owner of a Bavarian dealership that has been in business for 45 years, notes that the fast-moving technology advancements may have some holding out for more future-proof EV options.

“The main problem is uncertainty,” Niedermayer said. “Many assume that the technology will improve and would rather wait three years for the next model than buy a vehicle now that will quickly lose value.”

Flavia Garcia and Tom Carvell in Edinburgh, Scotland, are in the market for a new vehicle as their 15-year-old Toyota Auris requires replacement. Ahead of gas car sales bans, the couple says they would consider purchasing an EV if it weren’t for fears of charging infrastructure deficiency, battery life and sticker price.

“You want to do the right thing for the environment, but it feels like you’re setting yourself up for a very expensive investment that will make your life that bit more complicated,” Garcia told Reuters. “We’ll probably get a hybrid first.”

EV sales also slowed in September, and Felipe Munoz of JATO Dynamics says the slowdown will remain until affordable EVs are released.

Meanwhile, Tesla’s Model Y was the top-selling vehicle across Europe in September, and the company last month announced it had delivered one million vehicles across the continent. The U.S. EV maker is also rolling out its Model 3 Highland in Europe, set to continue over the next couple of quarters.

Other U.S. automakers, including Ford and General Motors (GM), have recently announced plans to delay the launch of more affordable EVs and to cut back on EV spending as they cite low demand. Over the weekend, it was reported that Ford will no longer build a plant with LG in Turkey, with the slowed pace of EV adoption being the main reason for the canceled plans.

“From a regulatory standpoint, they don’t have to push product out right now – they can afford to focus on profitability,” says Alistair Bedwell, GlobalData’s head of powertrain forecasting. “But they need to have an eye on Tesla and the Chinese brands, because they don’t want to get too far behind.”

According to a poll from the consumer research firm The Langston Co, hopes to buy an EV in Germany have remained steady in the past year, though rising sales suggest that some automakers have finally caught up to supply chain bottlenecks, according to Insights Manager Ben DuCharme.

Philip Nothard, insight director at dealer services firm Cox Automotive, says that concerns around low residual values have also lowered customer sentiment, with many choosing vehicle purchases based on what they think they can resell in a few years.

“We call it the valley of death, which we will be going through in 2024 to 2027: low residual values, high supply, and low demand,” Nothard said.