Key Takeaways

- Tesla is set to release its Q3 2025 earnings on October 22, 2025, after market close, anticipating record vehicle deliveries.

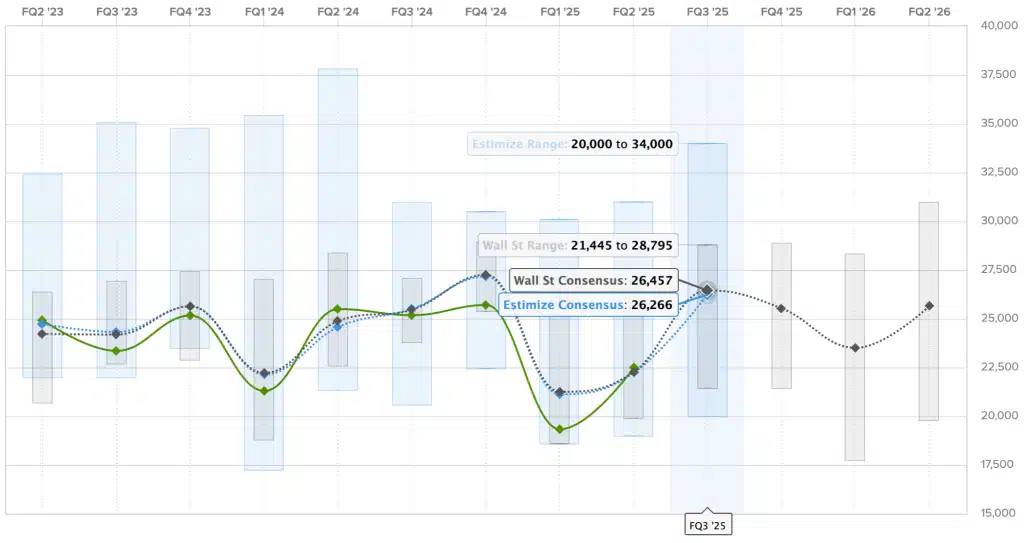

- Analysts expect Tesla’s revenue to reach approximately $26.457 billion, driven by record vehicle deliveries and energy deployment.

- Despite record revenues, expected earnings are seen to decline to around $0.55 per share, marking an ongoing downtrend in earnings.

- Tesla confirmed a deployment of 12.5 GWh of energy storage capacity this quarter alongside high vehicle production numbers.

- Management is expected to present an optimistic outlook during the earnings call, despite challenges expected in future quarters.

- Retail investors are particularly interested in updates regarding Tesla’s Robotaxi program, energy products, and new vehicle models.

- Elon Musk faces scrutiny over previous statements about self-driving timelines and potential delays in product launches, specifically regarding the Optimus robot.

In the world of electric vehicles, all eyes are set on Tesla as the company prepares to announce its Q3 2025 earnings on October 22nd, after the market close. Investors and enthusiasts alike are eager to see how the electric vehicle giant has performed during a quarter that’s anticipated to set new records in vehicle deliveries. Here’s a closer look at what to expect and what this means for Tesla moving forward.

Analyzing Expected Revenue and Earnings

Projected Revenue

For Q3 2025, analysts anticipate Tesla’s revenue to climb to approximately $26.457 billion. This surge is largely attributed to record vehicle deliveries and significant energy storage deployments. However, amidst this celebratory revenue growth lies a more complex narrative regarding earnings.

Earnings Expectations

Despite achieving record revenues, Tesla’s earnings per share (EPS) are expected to see a decline, estimated at around $0.55. This downtrend is largely due to increased competition forcing Tesla to adjust pricing strategies. For avid watchers of Tesla’s financial health, this raises important questions about profit margins and the sustainability of growth in a competitive EV landscape.

Breaking Down Vehicle Deliveries and Energy Deployment

Record Vehicle Deliveries

Tesla boasts a record number of vehicle deliveries this quarter. With production numbers impressive as ever, the company has managed to deliver 497,099 vehicles. This feat showcases Tesla’s manufacturing efficiency and market demand adaptability, yet it also hints at the pressure to maintain these numbers in the face of budding rivals.

Energy Deployment

Complementing its automotive success, Tesla confirmed the deployment of 12.5 GWh of energy storage capacity this quarter. This accomplishment signals Tesla’s commitment to expanding its energy product offerings, reflecting its broader strategy to entwine energy solutions with transport innovations.

Management’s Outlook and Market Projections

As the earnings call approaches, Tesla’s management is expected to project a highly optimistic outlook. This is likely a strategic move to maintain investor confidence amidst future challenges. Analysts will be scrutinizing how Tesla plans to navigate these hurdles and leverage its current successes.

Key Areas of Interest for Investors and Analysts

Several pertinent questions loom over Tesla’s horizon, most notably regarding:

- Robotaxi Program: Investors are keen to understand the advancements and challenges facing Tesla’s autonomous vehicle ambitions. Despite Elon Musk’s bold predictions, market confidence is contingent upon tangible progress and regulatory milestones.

- Energy Products: As Tesla deepens its involvement in energy systems, shareholders are particularly interested in the development of product lines like Megapack and Powerwall, and how these fit into Tesla’s long-term vision.

- New Vehicle Models: With competition heating up, Tesla’s strategy for introducing new models, particularly in affordable segments, is under the spotlight. Stakeholders are eager for announcements regarding novel vehicle designs and platform utilizations.

Challenges on the Horizon

Elon Musk and Tesla have never shied away from ambitious goals, yet sustaining momentum requires facing several challenges head-on:

- Self-Driving Technology: Persistent scrutiny surrounds Tesla’s self-driving timelines, with Musk’s bullish proclamations continuously facing delays. Bridging the gap between expectation and execution remains a key concern.

- Product Launch Delays: The Optimus robot, amid development delays, exemplifies the hurdles Tesla must overcome to maintain its innovative leadership.

A Balancing Act for Continued Dominance

As Tesla unveils its Q3 2025 financials, the company stands at a crossroads. While setting enviable records in vehicle deliveries and energy deployment, challenges in maintaining profit margins and technological advancements cannot be ignored. How Tesla manages these dynamics will determine its trajectory in the electrified future.